The business world is a competitive one. To stay afloat, businesses should be able to manage inventory and account for every penny that goes into or comes out during each day’s transactions. It prevents the path toward bankruptcy! But what happens when you don’t have enough staff on hand? Well, luckily you can learn how to use QuickBooks.

Solutions like QuickBooks small-business software are designed specifically with smaller companies’ needs at heart – it can help make your life easier while still keeping your books straightened up tight so nothing gets overlooked.

Whether you’re a startup just getting off the ground, or a well-established company looking for ways to streamline your accounting process, QuickBooks has the features you need to make your business thrive. This article will help guide your way through using QuickBooks and you’ll learn how to maximize your business with its features. Let’s begin.

Why and How to Use QuickBooks Versions?

Being a business owner, who doesn’t want to streamline business operations and save time. QuickBooks help you achieve this. QuickBooks allows you to track your income and expenses, create invoices and manage your finances in one place. It’s simple to use and can save you a lot of time and hassle. Plus, it’s affordable, which makes it a great option for small businesses.

QuickBooks is available in four different versions: QuickBooks Pro, QuickBooks Premier, QuickBooks Enterprise, and QuickBooks Online. Each version has different features and functionality, so users can learn how to use QuickBooks versions that best suit their needs.

- QuickBooks Pro

- QuickBooks Premier

- QuickBooks Enterprise

- QuickBooks Online

Whichever version of QuickBooks you choose, you can be sure that it will help you manage your finances effectively.

10 Ways to Use QuickBooks for Small Businesses

If you’re not sure how to use QuickBooks for small businesses, we’ll help. QuickBooks comes with plenty of features that are helpful and we are going to show you the top ten of it and what they can do for you.

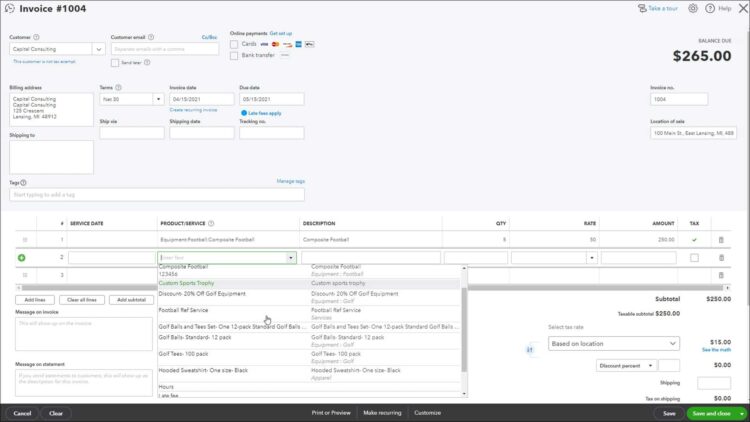

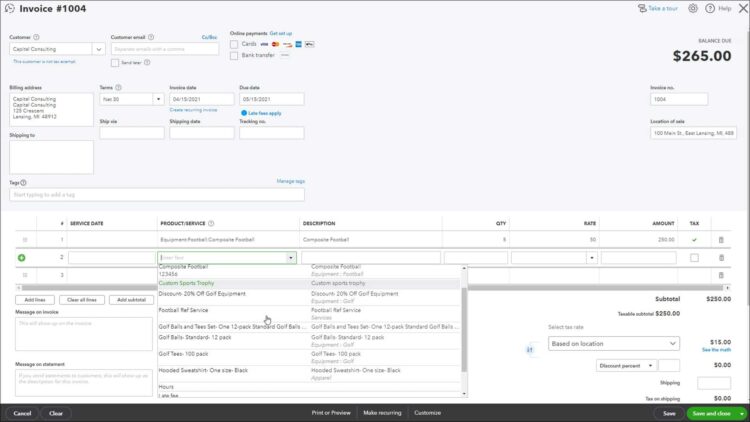

1. Creating and Tracking Invoices for Payments

Invoicing and payments are essential for any small business. With QuickBooks, you can create professional-looking invoices with your company logo, track payments, and see which invoices are outstanding.

You can set up recurring invoices, so you don’t have to enter the same information over and over again. QuickBooks makes it easy to get paid by accepting credit cards, debit cards, and ACH payments.

It also helps send reminder emails to customers who haven’t paid their invoices yet. QuickBooks integrates with popular payment processors like PayPal and Stripe, so you can easily accept payments from your customers.

Read More: How do I contact QuickBooks Payroll Support Number

2. Tracking Bills & Expenses for Taking Decisions

Every business has to track its bills and expenses to make informed decisions about where its money is going. This is especially important for small businesses, which often have limited resources and need to be very mindful of their spending.

When you learn how to use Quickbooks, you can track your bills and expenses and see exactly where your money is going. This can help you make informed decisions about where to cut costs, and can also help you spot potential areas of waste.

This information can be invaluable in making decisions about the future of your business. You can take care of all your financial paperwork in one place with QuickBooks, which automatically downloads and categorizes every bill you receive. You’ll never have to worry about lost bills or forgotten transactions again!

3. Print Financial Statements for Your Business

Financial statements are one of the most important tools that small business owner has at their disposal. They provide key insights into the financial health of the business and can help to identify areas where improvements need to be made.

QuickBooks includes a range of features that make it easy to track income and expenses, prepare invoices, and generate financial reports. One of the most useful features of QuickBooks is its ability to generate financial statements.

These statements can be customized to suit the specific needs of the business, and they can be exported to PDF or Excel for further analysis. It also helps justify your business health and comes in handy when you apply for a loan. QuickBooks allows you to prepare three major financial statements that you need.

Profit and Loss Report

This type of report can be very useful in helping business owners to see where they are making and losing money. By knowing where their profits are coming from, they can make better decisions about how to spend their money.

Additionally, by learning how to use QuickBooks, businesses can see where their losses are occurring, and they can take steps to prevent those losses from happening in the future. As a result, Profit and Loss reports can be a valuable tool for small businesses that use QuickBooks.

Balance Sheet Report

Balance sheet reports provide valuable information about a company’s assets, liabilities, and equity. They can help business owners track progress and make informed decisions about the future. In addition, if you face any trouble while using QuickBooks, you can contact QuickBooks and they’ll help.

Cash Flows

This statement shows how much money is coming in and going out of the business on a daily basis. This information is crucial for businesses to have so that they can make informed decisions about where to allocate their resources. Having a cash flow statement also allows businesses to identify any potential problems early on so that they can take steps to correct them.

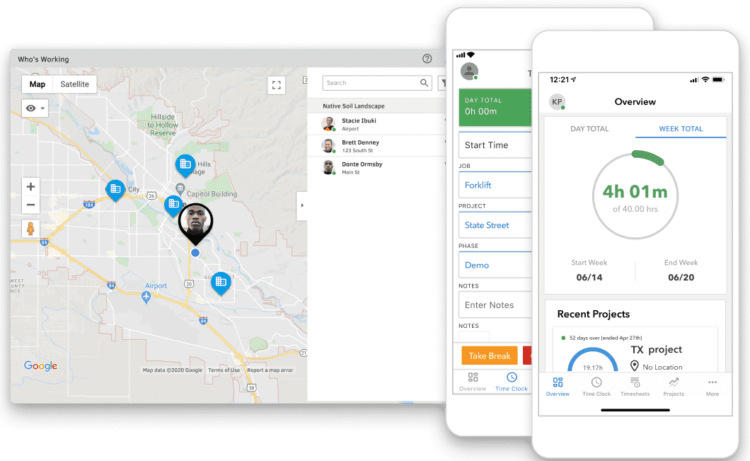

4. Track Time & Expenses of your Employees

Every business owner knows that employee productivity is crucial to the success of the enterprise. What many don’t realize, however, is that tracking time and expenses are an essential part of ensuring that employees are working efficiently.

QuickBooks can help business owners accomplish this goal by providing a simple and effective way to track employee time and expenditures. By inputting data into Quickbooks, business owners can get a clear picture of where their employees are spending their time and money.

This information can then be used to make informed decisions about where to allocate resources. It also ensures that your business is running efficiently and that you are getting the most bang for your buck.

Read More: Simple Ways For Converting Xero To QuickBooks Online

5. Manage Payroll Efficiently

Payroll is one of the most important aspects of running a small business. Employees need to be paid on time and accurately in order to maintain morale and avoid legal problems. Businesses must also withhold taxes and contribute to social security and other government programs. But it can be challenging for small businesses to keep track of employee hours and salaries.

QuickBooks payroll can help you manage the payroll quickly and efficiently. It allows you to record employee hours, calculate salaries, and automatically withhold taxes. It also helps you keep track of your business expenses, so you can make sure that your payroll is accurate. In addition, QuickBooks payroll integrates with QuickBooks versions, making it easy to track your financials.

6. Track Your Inventory

Tracking inventory is essential to ensure that you have the right products on hand to meet customer demand. You can learn how to use QuickBooks and track your inventory levels, so you always know what you have in stock and can order more products as needed.

![]()

QuickBooks can also help track your inventory costs, so you can see how much money you are spending on inventory and whether or not you are making a profit. In addition, it can help you track sales data, so you can see which products are selling well and which ones are not.

7. Accurate & Simplified Taxes

Taxes are a complex and confusing subject for many small business owners. Not only do they have to contend with constantly changing tax laws, but they also have to keep track of a variety of different expenses and income streams. This can quickly become overwhelming, particularly during tax season.

QuickBooks can help take the complications out of tax time by printing financial statements and generating reports that simplify the tax preparation process. In addition, QuickBooks can track sales tax and prepare 1099 forms, ensuring that all of your business’s tax obligations are met. As a result, it saves you a significant amount of time and hassle come tax season.

8. Accept Payments Online

In today’s world, customers expect to be able to pay for goods and services online. If your small business doesn’t offer online payment options, you could be losing out on sales. QuickBooks Payments makes it easy and affordable for small businesses to accept online payments so that their customers can pay their invoices quickly and easily.

QuickBooks Payments is a merchant service that is integrated completely within QuickBooks, so that sales, credit card fees, and cash deposits are all recorded automatically as they occur. This makes it easy for small businesses to keep track of their finances and also make sure that they are getting paid on time.

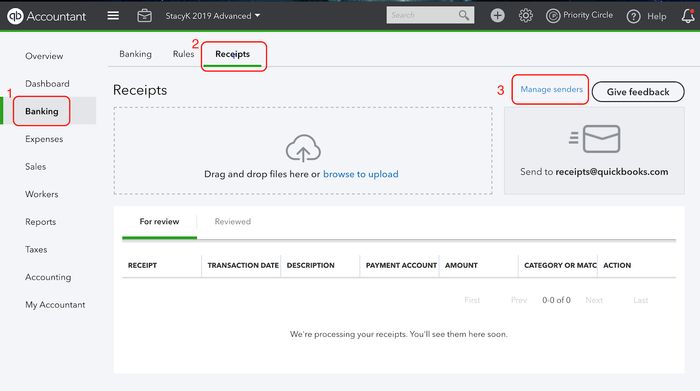

9. Scan Receipts

As a small business owner, it’s important to stay organized and on top of your finances. One way to do this is to learn how to use receipts in QuickBooks for small businesses. You can scan your receipts and keep track of your expenses without spending a lot of time on them.

QuickBooks offers a convenient way to attach receipts to corresponding banking transactions, so you can always have access to your records. And because the receipts are stored in the cloud along with your data, you can upload an unlimited number of them.

You’ll never have to worry about losing a critical piece of documentation again. QuickBooks gives you the peace of mind of knowing that your financial records are always safe and accessible.

10. Track Mileage

Whether you have a small business or an established one, you constantly seek new ways to save money. One way to do this is to track your mileage. This may seem like a small expense, but it can add up quickly.

Tracking your mileage will help you to know how much you are spending on gas and maintenance for your vehicle. QuickBooks will automatically calculate the total miles driven. You can then categorize each trip as business or personal, and add additional details such as the purpose of the trip and any tolls or parking fees paid.

This information can be helpful come tax time, as business-related travel expenses are tax-deductible. In addition, tracking your mileage can help you identify patterns and optimize your travel routes to save time and money.

Read More: How To Update QuickBooks?

Choosing the best QuickBooks Version

As a business owner, you know that QuickBooks is an essential tool for tracking your finances. But with so many different versions of QuickBooks on the market, it can be hard to know which one is right for your business. Let’s find out.

1. QuickBooks Online

You can learn how to use QuickBooks online for small businesses and get all the features of the desktop version of QuickBooks, but it’s also much more affordable and easier to use. Here are just a few more reasons why you should choose QuickBooks Online for your small business:

- QuickBooks Online is more affordable than the desktop version.

- It is easier to use, particularly for small businesses that don’t have dedicated accounting staff.

- It is cloud-based, so you can access your account anywhere, anytime.

- You can integrate it with a number of popular business apps, making it even easier to manage your finances and keep track of your spending.

- It’s affordable, easy to use, and packed with features that will help you run your business more efficiently.

2. QuickBooks Desktop

QuickBooks Desktop is a comprehensive accounting software solution designed specifically for small businesses. It offers a wide range of features and functionality, making it an ideal choice for businesses of all sizes. However, learning how to use QuickBooks Desktop also has a number of unique advantages that make it the best choice for small businesses.

- QuickBooks Desktop is extremely user-friendly, with an intuitive interface that makes accounting tasks quick and easy to complete.

- It is highly customizable, allowing businesses to tailor the software to their specific needs.

- It offers exceptional support and training resources, ensuring that businesses can get the most out of the software.

3. QuickBooks Self-Employed

QuickBooks Self-Employed is a powerful tool that can save small businesses time and money. It is designed specifically for self-employed individuals, and it offers a number of features that are not available in other QuickBooks versions. It includes a mileage tracker that can automatically record business-related expenses.

In addition, QuickBooks Self-Employed offers free bank reconciliation and invoicing. With this version, you may learn how to use QuickBooks small business software for personal finances. However, one thing that has been missing from this version is an upgrade path to another edition which would be perfect if you wanted more advanced tools for your business!

4. QuickBooks for Mac

If you use a Mac computer or iPad for your business, QuickBooks for Mac will integrate seamlessly with your existing hardware and software. In addition, QuickBooks for Mac offers all of the same features as the other versions of QuickBooks, including tracking sales and expenses, preparing invoices, and managing inventory.

However, it also includes some unique features that are tailored for businesses that use Apple products, such as the ability to sync with iCloud and use Face ID for security. If you’re looking for an accounting software program that is designed specifically for businesses that use Apple products, QuickBooks for Mac is a perfect choice.

Conclusion

If you’re a small business, learning how to use QuickBooks is an essential task. In addition to helping you stay organized and keep track of your finances, QuickBooks can also help you save money on taxes.

We’ve outlined some of the key features of QuickBooks that will be most useful for small businesses. If you are not already using QuickBooks to track your bills and expenses, now is the time to start. It could be the difference between a good or a bad outcome.

Frequently Asked Questions

Q1. Can a beginner work with QuickBooks?

QuickBooks is packed with features that can save businesses time and money. And while it may seem daunting at first, QuickBooks is actually fairly easy to use, even for beginners. The software is designed to be user-friendly, and there are plenty of resources available to help you get started, including tutorials and online support forums.

Of course, it always helps to have some basic accounting knowledge before learning how to use Quickbooks. But with a little time and effort, anyone can learn to use QuickBooks – even if they have no prior experience with accounting software.

Q2. How to use QuickBooks for free?

There are a few different ways that you can learn QuickBooks for free. The first way is to find a tutorial online. There are many websites that offer free tutorials on QuickBooks, and you can often find one that covers the specific features that you want to learn.

Another way to learn how to use QuickBooks for free is to take an online course. There are plenty of courses available, and you can often find one that is specifically designed to teach you QuickBooks. You can also download a free trial of QuickBooks and use it to practice your skills. This will allow you to get a feel for how the software works before you commit to purchasing it.

Q3. How does QuickBooks help small businesses?

QuickBooks include features that allow businesses to track progress towards financial goals and create reports for tax purposes. When you learn how to use QuickBooks for small businesses, you can track income and expenses and see where the money is going and identify areas for improvement. It also helps businesses manage invoicing, inventory, and employee payroll.