Efficient inventory management is very important for businesses to maintain smooth operations and accurate financial records. However, problems can arise which can ultimately lead to issues like QuickBooks Negative Inventory. The QuickBooks Negative Inventory issue is generally caused when the user enters the sale transactions before the purchase transactions, which means that the user has sold the inventory products that are not in stock.

In this article, we will tell you about QuickBooks Negative Inventory, exploring its causes, and implications, and offering practical solutions to address this issue. By gaining an understanding of this topic, businesses can ensure optimal inventory control and mitigate the potential risks associated with negative inventory report in QuickBooks. So now let us get to know more about this.

What is QuickBooks Negative Inventory?

QuickBooks Negative Inventory is a situation where the quantity of inventory recorded in QuickBooks shows a negative value. This occurs when more items are sold or used than the available stock. It is a discrepancy that needs to be addressed to maintain accurate inventory records and avoid potential issues in financial reporting and inventory management. It is basically an error that arises when the amount of the sale and the purchase do not match. Let us see how it works.

When the User Sells the Product that is Recorded in the Company File

- You buy products using the Items Tab on the item receipt bill, credit card, bill or check and crediting cash, A/P, or Credit Card Payable.

- Then you can sell the products from the inventory. However, the user can never sell more than the stock items.

- The sale transaction records two transactions.

- Editing A/R and crediting sales: Sale/ Receivable transactions.

- Crediting Inventory and debiting COGS: Inventory/ COGS transactions.

- Run the P&L and expense report that shows the invoices and sale receipts.

- Run B/S reports that show item receipts, checks, bills, and credit card charges.

When the User Sells Products that have NOT been Entered in the Company File

- Saves the invoice data for the Receivable/ Sales transactions as expected.

- For the products that are not on hand, QuickBooks assumes them as:

1. Same as the average cost of the other item on hand.

2. The cost of the item from the item list. - QuickBooks COGS/Inventory transaction using the assumed price.

- To correct the difference, QuickBooks does not assume the cost of the next purchase and then the purchase transaction will be recorded as QuickBooks inventory adjustment.

Also Read: Complete Guide to Doing a Journal Entry in QuickBooks Online

What Triggers the Negative Inventory?

There are a bunch of triggers that can cause a Negative Inventory Adjustment account. Read the list below to understand the issue in depth.

- The damaged data forced you to constantly rebuild the file to bring the B/S in balanced form.

- An imbalance of the cash-basis Balance Sheet might also be a reason for the occurrence of the error.

- The amounts of COGS and Profit could be incorrect.

- The data of the Balance Sheet Inventory Account might not be correct.

- You could have entered the wrong Vendor Reports.

- The system might encounter an overflow error.

- Error: Itemhistupdateengine.cpp — LVL_ERROR–Error: Verify item history Target average cost mismatch error

- Error: Verify Account Balance failed. Calc bal = 0.00, List bal = *overflow*

- Error: LVL_ERROR–Error: Verify Account: Invalid balance. The amount of overflow has occurred. Rcrd = 99.

- Error: Itemhistupdateengine.cpp — LVL_ERROR–Error: Verify Item History: Bad target COGS for Item.

Issues While Using QuickBooks Negative Inventory

Below are a few issues a user might face while using the QuickBooks Negative Inventory. Let us discuss them pointwise.

New Inventory Product With No Average Cost:

- If, the user has created a new inventory product, with the Product Cost but does not add an initial QOH/ VOH. QuickBooks will assume that the product has no average cost. Instead of a bill, the first transaction of the item would be used as an invoice. This would force the sale towards negative inventory. The cost price of the item would be different from your purchase price. The difference can cause an adjustment on the P&L report.

- If, the user has created a new inventory but without the Product Cost. Hence when the user would sell the item, it won’t have any inventory. QuickBooks does not have any data or information regarding the average cost, therefore it would calculate the mean cost of $0.00. As a result, the data will distort the data of your inventory and COGS. The data is not accurate until the user has established the average price with a credit card, bill, check, or Value On Hand/ Adjust Qty.

Negative Inventory Cause Errors in Supplier Reports:

The COGS/ Inventory is normal on the invoice. If the user would sell the out-of-stock inventory, it may cause the QuickBooks Inventory Adjustment to the next bill by adjusting the COGS/ Inventory transaction.

Inventory Assemblies Shows Incorrect COGS on Job Costing Reports

Let’s say you have an insufficient quantity in stock. Later you have created an assembly that would cost different from the average cost. This will adjust the Inventory of the build transaction- COGS, which generally includes the invoice. The build transaction would not further allow entering the details related to customers.

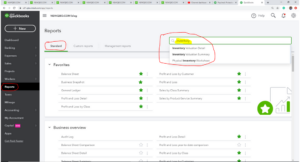

How to Check if the Data File Has a Negative Inventory?

Before solving the QuickBooks Negative Inventory, we first need to detect whether QuickBooks has any Negative Inventory or not. So if you are looking for finding negative inventory in QuickBooks then follow the following steps.

- Go to the QuickBooks software in your system.

- Choose the option Reports and then look for the Inventory option.

- Now tap on the option Inventory Valuation Detail.

- After following the above steps now search all the occurrences of the negative amounts in the column On Hand.

Also Read: Download QuickBooks Enterprise 2021 (Complete Installation Guide)

If you are using QuickBooks Premier or Enterprise 2014 without Advanced Inventory, then follow the steps below.

- Look for the Suppliers Menu and click on it.

- Click on Inventory Activities and then go to the Inventory Centre.

- Go to the top left of the Inventory Centre and try to change the filter from Active Inventory to Assembly to QOH <= Zero.

If you are using QuickBooks Enterprise 15.0 and later, then consider following these steps.

- Go to the menu of Reports.

- Choose the option of Inventory and then select Inventory Item Listing.

Points to Consider Before Resolving the Issue

If you are facing the same kind of problem, then you should consider the point before resolving the problem.

- You should create a backup of the company files without errors.

- Make sure that you have saved the backup in an easily accessible folder.

- QuickBooks negative inventory is a risky and complex task, hence it is better to start with a new data file.

How to Fix Negative Inventory in QuickBooks?

We have discussed the triggers and the symptoms of the arising of QuickBooks Negative Inventory. Now we would study the various steps of solving the issue. We have tried to discuss a complete process to resolve the issue of QuickBooks Inventory Adjustment. So let’s directly jump into the steps.

- Look for the Discover menu and then tap on the Reports option.

- Go to the Inventory and hit the option Inventory Valuation Detail.

- Choose the drop-down arrow and go to the Dates, tick all.

- Scroll the Reports that display the negative amount in the column On hand.

- Perform the settings of the bill with the accuracy of the date.

- After following the steps, try to repeat steps number 3 and 4 again.

Sales Initial Transaction:

When the data of the QuickBooks inventory reports are not correct, the average cost of the product is missing. But the user can easily access the accurate value according to the value of the recent transactions like set on hand Qty/ value, credit card, bill, check, etc.

- Navigate the Reports menu and then hit Inventory.

- After that click on the Inventory Valuation summary.

- QuickZoom and view the double item displaying inaccurate values.

- View the initial bill to run the bill window.

- Try to change and modify the bill date before the date of the starting invoice.

- Click on the Save option and then close it.

- Check the incorrect product and then modify it.

Enter the Purchase Before Sales:

- Change the settings of the dates.

- Navigate the Menu bar and then press the reports.

- Go to the Inventory option and hit the Inventory valuable detail.

- Select the drop-down, click on the Dates, and then hit the All button.

- Change the date of the bill.

- Save the changes.

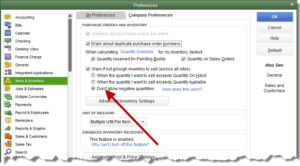

How to Prevent Negative Inventory?

To avoid the issue, you should not sell the inventory items until you have purchased the product or updated QuickBooks purchase data.

Set up the Inventory Items with an Opening Balance

- Try to create the inventory product and then enter the required information.

- Then enter QOH and Value to establish the mean cost.

- Purchase before entering the sale. Avoid it if you do not have any product on hand.

Use the Sales Orders or Estimates to Enter the Sales

- Type the order of the customer as a Sale Order.

- Or, you can also enter the customer order as the Invoice.

- Then the user can mark the Invoice as Pending. To do that, go to the Edit option and then Mark the Invoice as Pending.

- Make sure to buy the items first and then enter them into the company data file.

- After following the above steps, you can convert the Sales Order to an Invoice or you can even mark the Invoice as the final one.

Also Read: QuickBooks Error 15215-Causes, Symptoms, and Solutions

Use Pending Invoice to Enter the Sales that have Inventory

- In the Invoice, enter the customer order.

- Then go to the Menu bar, and choose Mark Invoice As Pending.

- Buy the inventory item before entering it into the company data file.

- Go to the menu bar, choose Edit, and then Mark Invoice as Final.

- Adjust or change the Invoice date to the shipment date of the items.

Final Note!

Above is a full guide about the QuickBooks Negative Inventory. We have discussed the reasons, causes, symptoms, and solutions of the QuickBooks inventory negative numbers along with what happens in QuickBooks if inventory is negative and QuickBooks negative inventory repair. However, if none of the methods helped you to resolve the issue you are facing, then try to contact the customer support of Intuit QuickBooks. We will make sure that you can perform the fixing of negative inventory in QuickBooks. You can easily access the Helpline Number in front of the official website of the software. Hopefully, the article was informative and helpful to you.

Frequently Asked Questions (FAQs)

Q1. What happens if inventory is negative?

If the inventory is negative in QuickBooks, it indicates that there are more items sold or used than what was initially in stock. This can happen due to errors in data entry or mismanagement of inventory. It is important to identify and rectify negative inventory to ensure accurate financial records.

Q2. How do I correct inventory in QuickBooks?

To correct inventory in QuickBooks, you can follow these steps:

- Identify the reason for the inventory discrepancy, such as missing items or incorrect quantities.

- Adjust the inventory by recording a journal entry or using the “Inventory Adjustment” feature in QuickBooks.

- Update the quantities and values of the affected inventory items to reflect the correct information. This helps maintain accurate financial records and inventory tracking in QuickBooks.

So this is how you can adjust negative inventory QuickBooks.

Q3. Can inventory be written down to zero?

Yes, inventory can be written down to zero in QuickBooks. You can use the “Inventory Adjustment” feature to reduce the quantity and value of the inventory item to zero. This is useful when you need to remove an item from your inventory due to obsolescence, damage, or other reasons.