Quicken vs QuickBooks: Features, Benefits, Pricing & Reviews

Managing a business’s finances manually is time-consuming and error-prone. This causes uncertainties in a growing business environment. This is where accounting software steps in. Modern accounting tools like Quicken and QuickBooks has transform the way businesses manage their daily financial operations. Accounting software works effectively in tracking income and expenses for payroll management, generating tax reports, sending invoices, and organising inventory.

No matter if you are a business owner with a growing team, a freelancer, or a landlord managing rental properties, choosing the right accounting software can save hours on keeping you audit-ready.

Among the accounting software available online, the two names that consistently top recommendation lists are Quicken and QuickBooks. Both of these consists certain advantages in their own right, but they serve very different purposes. In this guide, we have offered a detailed comparison between these two so that you can understand which suits your needs.

What Are Quicken and QuickBooks?

Before you dive into the comparison, let’s understand what Quicken and QuickBooks are and what purposes they are built for. While both of these software are accounting software, they serve fundamentally different audiences and business needs. Quicken is designed for individuals managing personal finances, small businesses, and rental incomes. On the other hand, QuickBooks is perfect for a full-scale business designed to handle the complex financial demands of small to medium-sized businesses. Understanding the core distinction will help you to evaluate the perfect software to match your financial goals.

What is Quicken?

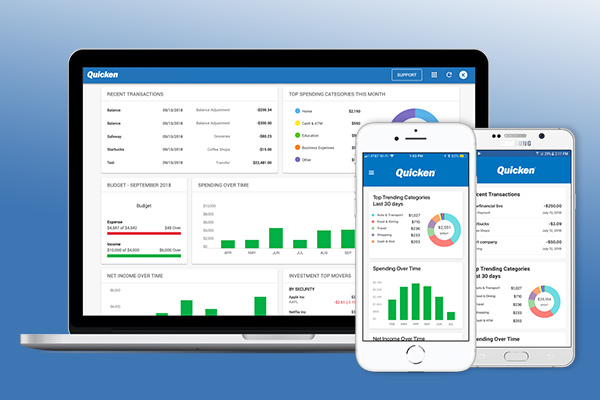

Quicken is personal accounting software, exclusively designed to manage your money in the cloud. With Quicken, users are allowed to track income, expenses, and cash flows and also manage all their property-related finance like rental land or buildings, handling taxes, creating custom invoices, and tracking investments.

Quicken makes it easy to organise and streamline the accounting tasks in one place as well as financial tasks. You can manage your money tab whether you are using the web, desktop, or mobile. Quicken is mobile-friendly software. A single click on your smartphone allows you to see your entire finance tab, including expenses and incomes. This tool is cost-effective as well as handy for your personal business.

Read More: How Do I Talk to Someone at QuickBooks?What is QuickBooks?

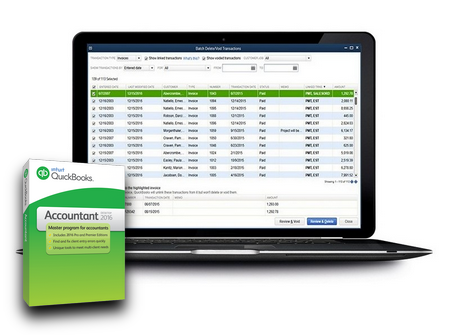

QuickBooks is an accounting software package developed and marketed by the American software company Intuit. This software is exclusively made for small and medium-sized enterprises to make their accounting and bookkeeping work easy. With the help of QuickBooks, the user can keep managing income and expenses and also track the financial health of the business. Additionally, QuickBooks allows the user to manage and pay the bill, accept business payments, function payroll, track business growth, and also set reminders for further payment.

Now that we know exactly what Quicken vs QuickBooks are, we can go further to compare both software with each to conclude which is best for your business type. This comparison is based on different aspects in an explained way so scroll down to know how to compare Quicken vs QuickBooks in depth.

Quicken vs QuickBooks in Terms of Major Differences

In order to make the right choice, it is required to create a clear understanding of how these two accounting software differ. In the section below, we have discussed both of these in a comprehensive, categorised comparison. The purpose is to assist you in choosing the right fit allining with your business and budget.

Read More: QuickBooks Install Diagnostic Tool - Download & SetupQuicken vs QuickBooks in Terms of Features

Both accounting software are made to manage the financial business requirements, one for small businesses and the other one for home & business. This comparison is based on the features that both accounting systems have.

| Feature Category | QuickBooks | Quicken Home & Business |

| Primary Use | Full business accounting solution | Personal finance with small business & rental tools |

| Income & Expense Tracking | Tracks across multiple business accounts with automation | Tracks personal, rental, and small business transactions separately. |

| Invoicing | Advanced invoice customisation with payment reminders | Basic invoice creation and email options |

| Online Payments | Accepts online payments directly | Limited payment integrations (e.g PayPal Links ) |

| Tax Management | Automatic tax categorisation, sales tax tracking, and 1099 management | Tools for maximising deductions and tax reports |

| Financial Reports | Profit & loss, balance sheet, cash flow, custom reports | Profit & loss and cash flow reports |

| Bank Integration | Direct bank feeds and reconciliation | Syncs with bank accounts |

| Multi-User Access | Allows multi-user access | Primarily single-user focused |

| Mobile Access | Dedicated mobile app | Web & mobile sync (optional feature) |

| Best For | Small businesses, growing companies | Freelancers, contractors, and rental property owners |

Also Read: Methods To Convert Quicken To QuickBooksQuicken vs QuickBooks in Terms of Pricing

When comparing the pricing, one must look at the billing structure, scalability, and long-term value. From our analysis, QuickBooks offers a monthly subscription plan, and Quicken Home & Business offers an annual subscription plan. Here is a comparison of their pricing tiers:

QuickBooks: Subscription Plan

| Plan | Price (Yearly) | Key Highlights | Best For |

| Simple Start | $9/month | Invoicing, expense tracking, basic reports, 1 user | Solo business owners |

| Plus | $20/month | 5 users, inventory, time tracking, project profitability | Growing small businesses |

| Advanced | $38/month | 25 users, advanced reporting, batch imports, role permissions | Expanding businesses |

| Self-Employed | $14/month | Quarterly tax tracking, 1099 management, sales tax tracking | Freelancers |

Payroll Add-ons:

- Core: $45 + $4/employee

- Premier: $75+ $8/employee

- Elite: $125 + $10/employee

QuickBooks also offers a free trial of 30 days.

Also Read: QuickBooks Enterprise for Mac: Download and Installation GuideQuicken Home & Business: Annual Subscription Plans

| Plan | Price (Yearly) | Key Highlights | Best For |

| Starter | $35.99/year | Expense tracking, budgeting, and Excel export | Personal finance management |

| Deluxe | $51.99/year | Debt tracking, savings goals, retirement planning | Long-term planners |

| Premier | $77.99/year | Investment tools, tax planning, priority support | Investors |

| Home & Businesses | $103.99/year | Rental tools, P&L, cash flow, Schedule C & E reports | Freelancers & landlords (Windows only) |

Which is Easier to Use Quicken or QuickBooks, in Terms of Mobile App?

When it comes to mobile app usability, both QuickBooks and Quicken offer on-the-go access to financial data, but they differ in purpose. The QuickBooks mobile app is designed for business workflow, live accounting, and collaboration, whereas the QuickBooks mobile experience is more focused on personal finance management.

| Feature | QuickBooks Mobile App | Quicken Mobile App |

| Primary Focus | Business accounting tasks (invoices, expenses, reports). | Personal finance tracking (expenses, budgets). |

| Ease of Use | User-friendly for business tasks with intuitive menus and shortcuts. | Simple interface for personal financial insights. |

| Real-Time Sync | Syncs instantly with online company data. | Syncs with desktop data via cloud or manual updates. |

| Invoicing from App | Yes, send invoices and track payments. | No, limited to personal finance. |

| Expense Capture | Yes, add receipts, record expenses. | Yes, add expenses and receipts. |

| Reposting on Mobile | Limited essential reports. | Basic financial summaries. |

| Notifications/Alerts | Business reminders and follow-ups. | Budget and spending alerts. |

Quicken vs QuickBooks in Terms of Benefits

QuickBooks is built for business accounting and bookkeeping, offering robust tools that support payroll, invoicing, and tax tracking. Quicken, on the other hand, focuses on small-scale businesses and personal finances, such as rental tracking and personal budgeting. So, they both cater to different needs. Here is a detailed comparison of key benefits:

| Benefits | QuickBooks | Quicken Home & Businesses |

| Business Accounting | Comprehensive accounting features (invoicing, expense tracking, payroll, tax reports). | Limited business finance capabilities. |

| Scalability | Easily scales from small to mid-size business needs. | Best for individual users or small rental-based businesses. |

| Multi-User Support | Supports multiple users with role-based permissions. | Primarily single-user focused. |

| Integration | Connects with bank feeds, third-party apps, payroll, and CRM tools. | Syncs bank accounts and credit cards. |

| Automation | Automates invoicing, billing, and recurring transactions. | Helps to auto-track personal budgets. |

| Reporting | Advanced, customizable business reports | Basic financial summaries and personal insights. |

| Cloud Access | Web and mobile access with real-time sync. | Web and mobile sync mainly for personal planning. |

Quicken Vs QuickBooks in Terms of Customer Review

Customer reviews play a critical role in determining efficiency. Customer reviews often reflect how each tool meets users’ expectations. We have examined user feedback for both of these apps and have come up with the following information:

| Review Criteria | QuickBooks (Business Users) | Quicken (Personal/Small Business Users) |

| Ease of Use | Highly rated for business workflows and automation; some learning curve for beginners. | User-friendly for personal finance and basic business tasks. |

| Feature Satisfaction | Excellent for invoicing, payroll, tax tracking, and reporting. | Strong in budgeting, expense tracking, and rental management. |

| Mobile App Experience | Well-regarded for on-the-go business tasks. | Appreciated for personal financial insights. |

| Support Quality | Positive reviews for responsive support, though wait times may vary. | Good support with clear documentation and help resources. |

| Value for Money | Users see strong ROI for business accounting needs. | Great value for personal finances and rental tracking. |

| Overall Recommendation | Recommended for small/mid-sized businesses. | Recommended for individuals, freelancers, and rental home owners. |

Conclusion

Regarding the above words, both the software Quicken Home & Business and QuickBooks Online have their separate features and functions. Both software are good in their own way, but this post is all about comparison. So, in the QuickBooks vs Quicken post with all the discussion and comparison, QuickBooks is the more reliable and easy-to-use software in the review.

QuickBooks Online has more supportive features than the Quicken Home & Business accounting software in both desktop and mobile apps. Although Quicken has a separate section for personal and business expenses that people do not require mostly those who do not have any rental business.

In short, if you are having a business related to rental properties or you are a freelancer got o Quicken, but if you want a robust technology accounting software for your small business, QuickBooks Online will be the best option for you. You can also read the Installation guide for QuickBooks.

Frequently Asked Questions (FAQs)

QuickBooks helps small and medium-sized businesses, while Quicken is for personal use. So if you are confused between Quicken vs QuickBooks for small businesses and you are a business owner, then QuickBooks would be a better option for you. However, if you do not own a business and just want accounting software to manage your personal finances, then Quicken would be better for you.

Yes, you can transfer Quicken files to QuickBooks using the Conversion Utility tool. So if you want your personal account details and business account details in one place, then you can do it with the help of the conversion utility tool.

In order to convert a QFX file to a QuickBooks file, you can follow the steps given below:

- Go to the folder that contains your .qfx file.

- Then choose the file and click on the Convert to QBO button.