Payroll integration is one of the features included in the QuickBooks finance program. From the program’s interface, you may track and manage your company’s payroll. An employee can monitor information about his compensation, such as available vacation hours, by printing a pay stub along with his payment. It also acts as a physical record of the amount and date of his paycheck. Create pay stubs with the information you want your employees to see using QuickBooks’ Payroll Printing Preferences.

To print QuickBooks Paycheck Stubs – QuickBooks Desktop allows us to utilize plain white paper. With the format, QuickBooks Desktop employs a template or default layout, however, the typeface cannot be modified. The firm name, address, and phone number will display on the bottom and top of the page when we print pay stubs in QuickBooks on vacant paper.

When you use QuickBooks Desktop, you may choose to send the pay stubs to the employees. This is displayed as a PDF file that has been decrypted with a single password, which helps to preserve the format and layout of the pay stubs.

Explanation of QuickBooks Paycheck Stubs

Pay stubs provide your employees a complete summary of their wages, benefits, taxes withheld, and taxes paid on their behalf by you, the employer. They provide critical information that your employees need to make sure they’re getting paid correctly and that taxes are being deducted correctly. Pay stubs can also display how much vacation and sick time an employee has available, as well as how much has been utilized, depending on state requirements. If your firm has a benefits plan in which workers participate, their contributions will also show up on the pay stub.

However, your workers aren’t the only ones who benefit from pay stubs. Lenders and social assistance organizations often demand a recent pay stub (and occasionally many recent pay stubs) before lending money or awarding benefits since pay stubs display both current and year-to-date information.

Even if your employees don’t examine their pay stubs on a regular basis or require them for a lender or social services, you should still include one with each payment. Many states require you to give pay stubs to your employees, and other states have special requirements for electronic pay stub distribution.

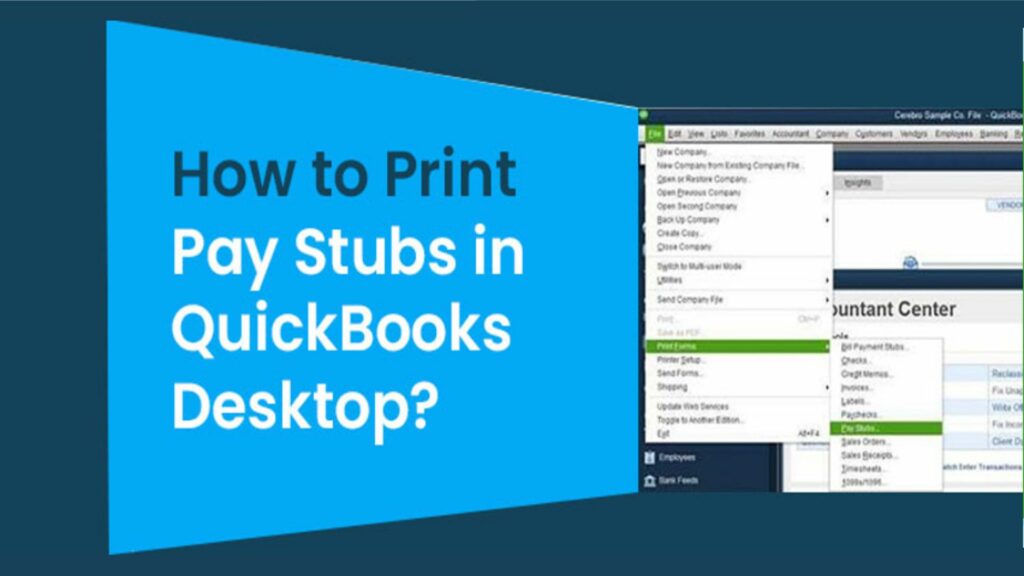

How to Print Pay Stubs in QuickBooks

To print a pay stub, follow the procedures outlined below.

- On the left side of the setup, select ‘Reports.’

- Select ‘Manage Payroll‘ from the ‘All Reports‘ drop-down menu.

- From the selection of reports, select ‘Paycheck List.’

- The report page will appear.

- Check-boxes will be used to choose the cheques or pay stubs you want to print.

- To open the ‘PDF‘ in a new window, click the ‘Print‘ button.

- Save this ‘PDF’ to your computer so you may print it later.

Print Pay Stubs in QuickBooks Desktop for Employee

- Go to ‘File,’ then ‘Print Forms,’ then ‘Pay Stubs,’ then ‘File,’ then ‘File,’ then ‘File,’ then ‘File,’ then ‘F’.

Choose your ‘Payroll bank account‘ and specify a date range that includes the pay stub’s pay date.

If you wish to filter from one employee to the next, use the ‘employee‘ option from the drop-down box. - Select the date in the ‘column’ beside it.

- Select the ‘pay stubs’ that you want to print.

- To examine the pay stub before printing it, select ‘Preview.’

- Now choose the company and personnel details by clicking on ‘Preferences.’

- Enter text in the Company message to be displayed on all pay stubs box if you want to print a global message on each pay stub.

- Finally, choose the ‘Print’ option.

Read More: Configure QuickBooks Firewall Ports

How to Create a Pay Stub from a Check

- To begin, open the pay stub on the QuickBooks desktop.

- Then, above the check, pick the ‘Print‘ option.

- Finally, choose ‘Pay Stub.’

Steps to Print Pay Stubs in QuickBooks Online

- First and foremost, ensure sure QuickBooks Payroll is enabled in QuickBooks Online. Hover over “Workers” on the left-hand side of the dashboard page, then click “Employees” to enable QuickBooks Payroll.

- Click the green Get Started button on the following screen.

- QuickBooks Payroll is a premium service not included in your QuickBooks Online subscription. Basic payroll costs $22.50 per month plus $4 per employee, while full-service payroll costs $62.50 per month plus $10 per employee.

- You’ll need to set up your payroll settings after you’ve activated your QuickBooks Payroll subscription.

- Select Payroll Settings from the Gear symbol in the top right corner of your screen.

- On the following screen, next to the Printing option, click the pencil symbol.

- Select your printing options next. You can select “simple paper” if all of your employees are paid by direct deposit. Otherwise, select your check stock type (one stub or two stubs) and save. Click “Done” after you’re through inputting your paycheck information.

Further steps:

- You’ll be able to print pay stubs in QuickBooks for your employees when you’ve authorized and performed your first payroll with QuickBooks Payroll.

- The Employees section now shows a list of your employees. To find an employee, type their name into the search box (a), or sort your list by Active Employees, Inactive Employees, or All Employees (b). To add a new employee, go to this screen and select the “Add an employee” button (c).

- For our purposes, the “Paycheck list” link is the most crucial thing on this screen (d).

- This screen’s default configuration is to display all paychecks from the most recent payroll run. By using the filter drop-down box, you may alter this setting to see prior paychecks.

- You’re ready to print your employees’ pay stubs once you’ve selected the relevant payment period. Choose the paychecks for which you wish to print pay stubs in QuickBooks. You may do this by choosing each checkbox individually or by clicking the checkbox next to the “Pay Date” section to select all the checks at once.

- The filter drop-down box will be replaced with a Print button after you pick paychecks.

- To make a PDF of your employees’ pay stubs, click the Print option. You can then print these on ordinary paper and deliver them to them. You can use QuickBooks web connector.

How to Get Paycheck Stubs From QuickBooks Online Direct Deposit – Details

You may also print pay stubs in QuickBooks to your employees electronically using QuickBooks. To begin, look into your state’s standards for electronic pay stub distribution. To get their pay stubs online, your employees may need to fill out an opt-in form.

If your state’s regulations allow you to provide pay stubs electronically, your workers can see them on the QuickBooks Workforce website at workforce.intuit.com. When you use the “Add an employee” button in QuickBooks Online to establish your workers’ profiles. You may invite the employee to examine their pay stubs and W-2s online if you want to (you must get employee consent to deliver W-2s online). By entering the employee’s email address and checking the box next to this option, an invitation to the QuickBooks Workforce site will be sent to the employee.

After you process payroll, your employees may log in and examine their pay stubs right away. By signing into their Workforce account, clicking Preferences, and then selecting “send me an email when new pay stubs are available,” they may also receive an email notification of new pay stubs. This email message will not include a pay stub; rather, it will inform your employees that a new pay stub is available for them to review.

You may also transmit a PDF of your employees‘ pay stubs to them with little danger of revealing their personal information because QuickBooks Payroll truncates their Social Security numbers. If you wish to email pay stubs to your employees, we recommend password-protecting the PDF.

Read More: QuickBooks General Ledger

Conclusion

It may take some time to password encrypt each employee’s pay stub individually, depending on your PDF production and editing program. The added step of personally sending each PDF adds time to this procedure. As a result, in most circumstances, we advocate entrusting the electronic distribution of pay stubs to QuickBooks Workforce.

If you liked our blog post, drop down a comment and let our team know. Also, check k out other posts. They are going to be of great use to you.

Frequently Asked Questions

Q1. Do QuickBooks generate pay stubs?

In addition to printing pay stubs, QuickBooks allows users to generate them. However, to use Intuit Payroll services, you must have a membership.

Q2. In QuickBooks, how could we print our pay stubs?

QuickBooks payroll feature is the sole way users print pay stubs. You can only make or print the checks and stubs in your QuickBooks program if you have a subscription to Intuit Payroll Services (any version).

Q3. How can I change the QuickBooks paystub template?

The following procedures will allow you to modify the QuickBooks paystub template:

- From the edit option, tap references, then choose payroll > employees.

- Select the buttons to print vouchers and pay stubs.

- In the payroll-related printing preferences window, uncheck the boxes that show the information.

- Press the “OK” button two times.

Q4. Is it possible to alter items so they appear on pay stubs?

When printing paystubs in QuickBooks, you can control the following elements based on your needs:

- Name of a legitimate business

- Vacation time and sick days

- Hours worked by salaried employees

- Name of DBA company

- Employer identification number issued by the federal government

- Non-taxable business goods

- Phone number of the company

Q5. What are the various QuickBooks paystub printing options?

The following methods are available in QuickBooks for printing paystubs:

- Through the paycheck.

- Through the printing of vouchers

- Using the paystub list

- through stubs for bill payments

- Through the printing of vouchers

Q6. Can you print account names on a check voucher?

The answer is that you can print and add account details to your check voucher.

The steps are listed below:

- Select preferences from the edit menu.

- Click the corporate preferences tab after tapping the checking option.

- Click the “OK” button after selecting the desired account name to be printed on the voucher.