Financial accounting is the most crucial part of any business. It involves balancing the sheets, checking the Profit and Loss accounts, cash-flow statements, and many more. While managing such tasks, it is obvious that one has to avoid any kind of mistake. This is where the role of QuickBooks General Ledger comes into play.

So, when you make and receive a payment or do any transaction – it is important to create a journal entry. After that, all tasks will be added to the general ledger in QuickBooks. In this informative post, we will tell you all about General Ledger QuickBooks online, and how to find and print it.

What is a QuickBooks General Ledger?

A QuickBooks general ledger report QuickBooks helps in showing the list of transactions from all accounts based on a certain date range. It includes full details about any transaction transactions from and to your accounts. We know that there is a debit and credit account for each transaction, so, the general ledger on QuickBooks lists them all.

Also Read: Easy Steps To Delete Deposit in QuickBooks – Complete Guide

QuickBooks General Ledger: Important Terminologies

Let’s review some key terms before jumping into QuickBooks general ledger in more depth.

- Accounts Receivable: This section includes a record of the company’s sales and receipts including the client invoices that have not been paid.

- Accounts Payable: It consists of the company’s purchase record as well as those invoices that the organization has to pay.

- Payroll: It comprises the employee’s remuneration record. Also, the checks to be paid to the employees and payroll taxes.

How Important is General Ledger in QuickBooks?

QuickBooks general ledger is very important as you can keep track of your spending in your company. You can also check that the entries of transactions are related to the right account.

- You can distinguish business expenses from personal expenses.

- It helps in managing business expenses and you can pay them through personal funds.

- You can track your company expenditures.

- Maintains accurate records.

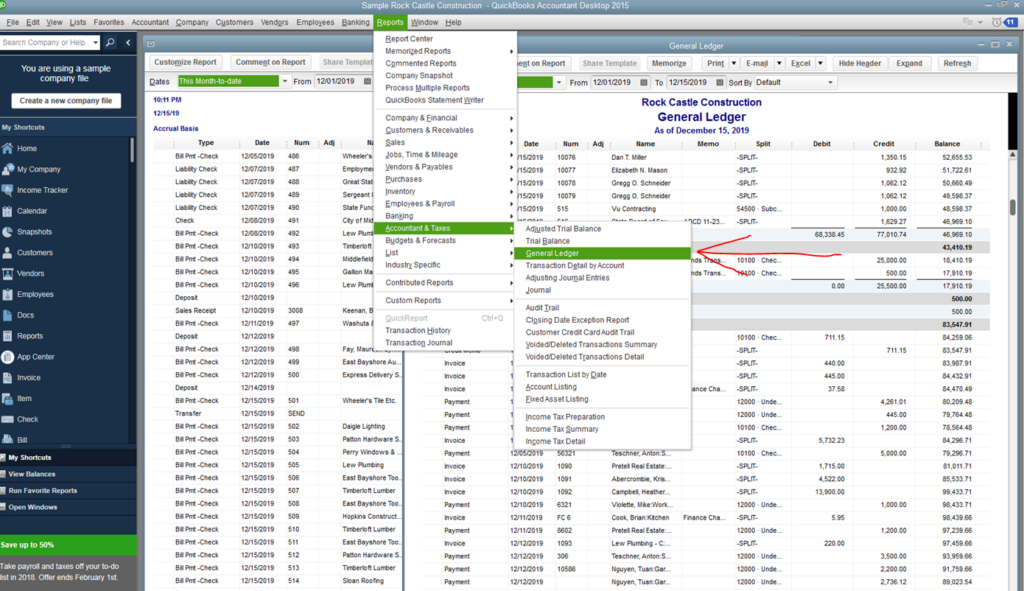

Steps to Find QuickBooks General Ledger

Go through the steps to find the general ledger QuickBooks:

- Firstly, sign in to QBs and select the Standard tab from the Report option.

- Then go to the Accountant section and choose General Ledger.

- After that, you need to choose a Date Range.

- Lastly, tap on Customize and see the Preferences.

How to Make a General Journal Entry in QuickBooks?

Here is what you do to create entries in QuickBooks general ledger. Follow the procedure given below for how to generate general ledger in QuickBooks.

- Firstly, visit the Company option and choose Make General Journal Entries.

- Now, supply information in the fields and you should see that your debit matches your credits.

- At last, click on Save and Close.

How to Print a General Ledger in QuickBooks?

Now you know the process to find and create a general ledger report QuickBooks, it is now much more convenient for you to print:

- Once you logged in to your QBs account.

- Tap on Print Reports then choose Transaction Reports and then select General Ledger.

- Then write Month & Year and if you want to print the account range then Enter the beginning and ending account number

- Now, click on Print and press on Start Printing.

Also Read: How To Update QuickBooks (Get Latest Tools and Features)

Conclusion

All in all, QuickBooks is a very useful tool for all businesses, especially small and medium-sized businesses. Now, it’s time to conclude this informative post on QuickBooks General Ledger. Here we told you about various things like how to create a general ledger, how to read a ledger, how to print it, edit it, etc. We hope that the information here is sufficient enough to serve you. If you have any queries then you can ping us anytime. We are always ready to help you.

Frequently Asked Questions

Q1. What is the difference between the general ledger and transaction detail by account in QuickBooks?

Some people might use the terms “general ledger” and “transaction detail” interchangeably, but in reality, these terms hold different meanings. A general ledger has the records of all your accounts that are linked with your QuickBooks account. Whereas, transaction detail has the records of only one particular bank account linked with your QuickBooks account.

Q2. What are the Benefits of General Ledger in QuickBooks Online?

- Helps in identifying Unusual transactions.

- Simple Inspection.

- Evaluation of the Financial health of your company.

- You can prepare a Tax summary.

- Particular Accounts Final Position.

Q3. Does a general ledger show all transactions?

Yes, a general ledger has a record of all the transactions. It is basically a record of all the transactions that you make through QuickBooks, be it through any account that is connected or linked to your QuickBooks account. It is quite helpful because you can see a record of transactions through different accounts in a single report only. This makes your overall work easy.