QuickBooks Error PS032 – Causes, Symptoms and Fixes

You were coming back from your office after having a cheerful day. But then you see a message that is “QuickBooks Error PS032” on your device. That arises when you are not able to download payroll updates. This is when you start getting frustrated. Because you might lose your company data and not be able to finish the work on time.

Well, don’t stress as we will help you to fix QuickBooks error PS032 with the best solutions. So, we think without wasting any time, we should get into it.

What is QuickBooks Error PS032?

QuickBooks Error PS032 prevails when you are trying to download payroll updates and this happens because of wrong data input or settings of software that are not done correctly.

It will throw a message stating “QuickBooks having trouble installing payroll tax table updates”.

Symptoms of QuickBooks Error PS032

Before the Error PS032 appears, the system shows warning signs that help you to address the issues early, before they disrupt the entire payroll workflow.

- Payroll Updates Fail to Download: You try downloading payroll updates, but the process fails repeatedly.

- Tax Table Update Gets Stuck: The tax table update process freezes or gets stuck halfway through, preventing users from completing the installation.

- System Freezes During Payroll: Your computer becomes unresponsive, specifically when you are working with payroll functions in QuickBooks.

- Missing or Outdated Payroll Feature: Outdated payroll features create compatibility issues with current tax rates.

Causes of QuickBooks Error PS032

Understanding the reasons behind Error PS032 assists you in fixing issues faster and reduces confusion. Some common causes behind this issue include:

- Damaged Tax Table Files: When your tax tables get damaged or corrupted, QuickBooks can’t process payroll updates properly, causing Error PS032.

- Incorrect or Outdated Billing Information: Wrong billing details or expired payment information in your payroll account stop QuickBooks from verifying your subscription.

- QuickBooks Registration Issues: When QuickBooks fails to read your software registration information, it can’t authenticate your license and blocks payroll updates from installing.

- Damaged Payroll Components: Corrupted payroll components interfere with the tax table update process and cause Error PS032 to appear.

- Corrupted Company File: A corrupted company file prevents QuickBooks from accessing the necessary information to complete the payroll update.

Also Read: Troubleshoot QuickBooks Script Error- 8 Easy MethodsPoints to remember:-

- Firstly, you have to validate the QuickBooks payroll subscription.

- You must have to update the QuickBooks Desktop to the latest released version.

- Make sure to take all the backups of the QuickBooks company file.

- Check whether the billing information entered in the payroll account is correct or not.

- Make sure you have only one QuickBooks software on your system.

How to Resolve QuickBooks Error PS032?

As an official support resource for QuickBooks Desktop users, we provide verified and technically approved troubleshooting methods to resolve QuickBooks Error PS032. This error is typically associated with payroll update or subscription validation issues and requires accurate, step-by-step resolution to prevent data disruption.

Below, our certified QuickBooks support guidelines outline the recommended procedures to diagnose and fix Error PS032 safely and effectively. Follow each method carefully in the order provided to ensure proper resolution and continued payroll functionality.

Method 1- Repair QuickBooks Software

When QuickBooks files get damaged, repairing the software can fix corrupted components, causing Error PS032. Follow the instructions which are given below to repair the QuickBooks software immediately.

- Initially, you have to close your QuickBooks Account.

- Then, close all the other system windows, and make sure that all the other windows are also closed.

- Now, open the Windows task manager and check all the windows of QuickBooks.

- After that, again open QuickBooks to download payroll updates.

- Lastly, if you still face any issues, then move to the file and click on the Utilities and Repair QuickBooks.

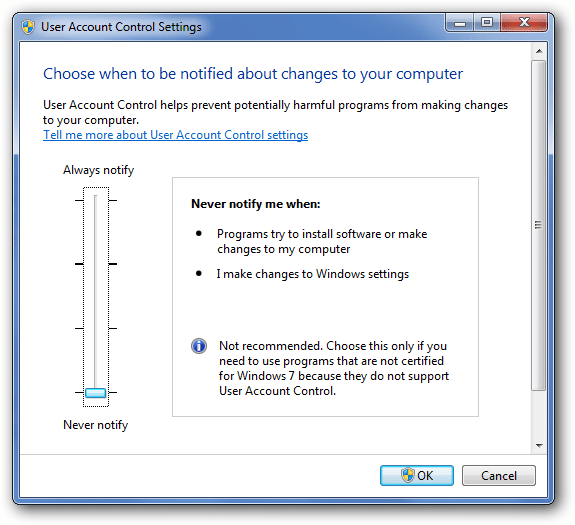

Method 2- Turn Off User Account Control

User Account Control (UAC) sometimes blocks QuickBooks from accessing necessary system files for payroll updates. Temporarily disabling it provides QuickBooks with the required permission for updating payroll.

- Firstly, log in to your Intuit account and check your QuickBooks license, verifying if you have the latest version of QuickBooks.

- Check all the details, like billing information and the date of the QuickBooks payroll service account information.

- Now, refer to the QuickBooks error technical support team to resolve.

- After that, move to the file > Utilities and then click on verify and create QuickBooks data.

- Lastly, if you are using Microsoft Windows 7 or 8, then you have to switch off User Account Control (UAC). and download QuickBooks payroll updates.

Conditions 1- If only One Version of QuickBooks Desktop is installed

Don’t follow these steps if you have only one version of QuickBooks Desktop.

- Take all the backups of the QuickBooks company files.

- Then close all the other applications.

- Now, open the Run Windows.

For Windows 8:

- Firstly, go to the Windows System sections.

- Then open the start tab.

- Now, you have to click on the background for all applications.

- Click on the Run options.

For Windows 7 and XP:

- First of all, click on the Start if you are not logged in as an admin.

- Now, go to the All Programs and then click on Accessories.

- Lastly, click on the Run.

For Windows Vista:

To open the Run box, then click on the Vista logo and then press and hold Windows +R keys:-

- Firstly, open the Control Panel.

- Then, go to the Programs and Features and then double-click on them again to add or remove the programs in Windows Vista.

- Now, the only version the user doesn’t need to continue the steps.

- The above steps will open the QuickBooks desktop installation wizard.

- Then, tap on the Next key.

- After that, choose to remove and tap on next. As per requirements, continue with the process.

- To complete the update, the error message must have a to-go option. And to retrieve the update, click on the yes and go online.

- The error may have the option to tap on OK to go online. Click on the Ok button and run the installation automatically. You may receive an error message again.

- Now, it is recommended to close QuickBooks if the data file is on the server. Also, run the payroll update from the server, and if you succeed in it, then install it on all other versions of QuickBooks.

Condition 2- If you have Multiple Version of QuickBooks

Initially, you have to install a clean version of the QuickBooks desktop to do well in selective startup.

- For multiple versions of QuickBooks Desktop.

- Clean all the additional installations.

- Reset the QuickBooks update.

- Now, you have to download the latest version of the payroll tax table.

- After that, resort to the lists and then use the verified data/ rebuilt data.

- Lastly, select clean uninstall/re-install in selective startup.

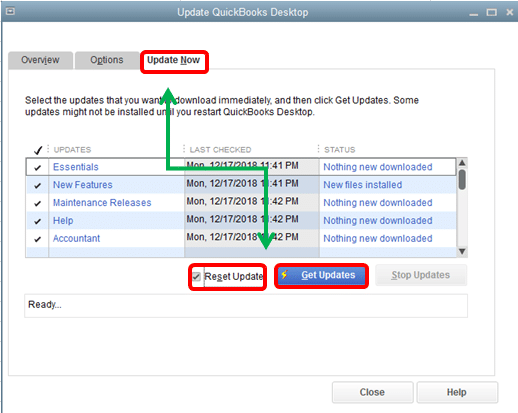

Method 3- Download the QuickBooks and Payroll Tax Table Latest Version

Outdated tax tables are a common cause of Error PS032. Downloading the most recent version ensures your payroll calculations are aligned with the recent tax rates and eliminates compatibility issues.

- Firstly, you have to remove the existing and the additional installations.

- Then, move to the help menu and select update QuickBooks.

- Now, reset the QuickBooks updates.

- Download the latest payroll tax table along with that.

- After that, re-sort the list of users of the verified data.

- Then, perform the clean uninstall in the selective start-up.

- Finally, update the tax table.

Method 4- Note the Billing Information

Incorrect billing information prevents QuickBooks from verifying your payroll subscription. Check your licence details to ensure everything matches.

- Firstly, click on the F2 key.

- Then, keep a note of your QuickBooks license number.

- Now, close the product information window by clicking on the OK tab.

Method 5- Rename the CPS folder

The CPS folder stores all your payroll configuration data. When it gets corrupted, renaming it forces QuickBooks to create a fresh folder with clean settings.

- Initially, press and hold the Windows + E key to open the file explorer.

- Then, select the Options tab.

- Go to the local disk C.

- Now, if you are not able to find the program file, then open the program file folder.

- Then, you have to open the QuickBooks desktop folder that resembles the version of your system.

- After that, open the components and move them to the payroll folder.

- Now, click on the CPS folder and tap on rename options.

- You have to rename it and type CPSOLD and tap enter.

- Then, make a new CPS folder and again open QuickBooks desktop.

- Lastly, download the latest version of the payroll tax table update.

Also Read: QuickBooks Error PS036 in DetailedMethod 6- Delete the .ecml File

The .ecml file sometimes becomes corrupted and causes an error. Deleting it forces QuickBooks to regenerate fresh entitlement information, often fixing the Error PS032.

To remove the .ecml file. To do this-

Step 1- Close QuickBooks desktop and end processes

- Don’t run QuickBooks, and ensure that no QuickBooks are running.

- Hit the shortcut key Ctrl + Shift + ESC, a modifier that will help access the task manager

- Press the process icon.

- To alphabetically sort the processes, hit the process name.

- Select all examples for “EXE,” and then the end task icon needs to be clicked.”

Step 2- Open the entitlement data folder

- To run, click Windows + R.

- Enter “C:/program data/intuit/entitlement client/v8” or (v6) and hit Enter option.

- Hold the ECML file, press Shift + F10 on it, and then hit the delete icon.

- After this, confirm by clicking on the yes tab.

Step 3- Register the software

- Click and open the QB company file.

- To register the software, follow all the commands given on the screen.

- Hit the payroll update service key once the registration part is over.

Read More: Resolve QuickBooks Error 15240Method 7: Update the Accountant’s Copy Along with the QuickBooks File

Outdated Accountant’s copies can cause conflicts with the payroll updates. Import the latest changes from your accountant to ensure all files are synchronised properly.

Part 1: Import Accountant’s Changes

- Open QuickBooks Desktop.

- Go to the File menu.

- Select the Send Company File Option.

- Then click on Accountant’s Copy.

- Select Client Activities.

- If your accountant sent a .qby file, select “Import Accountant Changes from File”.

- Locate the file on your computer.

- If your accountant has used the Accountant’s Copy File Transfer Service, select “Import Accountant’s Changes from Web”.

- Next, you need to follow the on-screen prompts.

Part 2: Review the Changes

- Click on Incorporate Accountant’s Changes.

- Select Close if you don’t want to import the changes.

- Click OK to confirm your changes.

- Lastly, close all Windows.

Method 8: Adding a New User Account to QuickBooks

Users’ permission issues can block payroll updates from installing. Creating a new administrative account with complete permission often resolves these access-related errors.

- Click the Windows key on your keyboard.

- Visit settings.

- Next, click on Account.

- Under “Other Users”, select “Add someone else to this PC”.

- Select “I don’t have this person’s sign-in information”.

- Select “Add a new user without a Microsoft account”.

- Enter a name for the new account.

- Click Finish.

- Select the newly created account.

- Click “Change Account Type”.

- Set your account type to Administrator.

- Next, click the OK button.

- Open QuickBooks using the new administrator account.

- Access your company files and try to update the payroll again.

Method 9: Verify Your QuickBooks License

Licence verification ensures QuickBooks recognises your valid subscription and allows payroll updates. Make sure that your licence is current and properly registered in the system.

- Log in to your Intuit Account online.

- Navigate to the QuickBooks subscription section.

- Check and ensure that your QuickBooks licence is active.

- Review your payroll service account information.

- Verify billing information, subscription dates, and payment status.

- Open the QuickBooks Desktop.

- Go to the File Menu.

- Click on the Utilities.

- Select “Verify Data” to check for corrupted files.

- If using Windows 7 or 8, temporarily disable User Account Control (UAC).

- Try downloading the QuickBooks payroll updates again.

Method 10- Turn off your Antivirus

Sometimes, a firewall hampers your work as it disrupts the smooth connection for the QuickBooks payroll updates to the servers. However, you can update it by turning off the firewall and antivirus settings once the issue is resolved, rather than just turning this setting on.

Method 11- Manually get the Latest Payroll Tax Table Updates

A tax table should always be the current version to resolve the QuickBooks error ps032. Since it cannot be automatically updated, but can be done manually, such as

- Open QB to hit the employee icon.

- From there, you can see the Get Payroll updates icon.

- After this, hit the download entire update option. You will get a list, and among them, you have to select the latest update to download.

- Finally, you will get updated through the information window when the tax table is updated to the latest version.

Read More: Resolve QuickBooks Error Message The File ExistsMethod 12- Verify the Status of your Payroll Subscription

An inactive or expired payroll subscription is a common reason for Error PS032. You need to verify your subscription to ensure it is active and properly configured in QuickBooks.

- Close the running app from your system and then set it to restart.

- Next, open QB.

- Before clicking on my payroll service, hit the employees option.

- Then press the manager service option.

- In this situation, check the status and service name where the status must be active.

- To verify the service key number, hit the edit tab.

- Enter the correct one if the first one was found invalid.

- Mark the open payroll set option as not selected by clicking the following icon.

- Finally, hit the finish tab, and you will receive the payroll update.

There is another method that you can use to fix this error. You need to download & access the QuickBooks tool hub to use Quick Fix My Program and QuickBooks file doctor to resolve this error.

How to Prevent QuickBooks Error PS032?

Prevention steps help you stop the issues from appearing again. This ensures uninterrupted payroll processing in the long term. These are some examples of measures you can consider to eliminate the error:

- Download only the latest payroll tax table as soon as it is released.

- Utilise QuickBooks file verification tools regularly to check corrupted payroll data.

- Verify that your account has the necessary administrator permission to access payroll functions.

- Keep your payroll subscription active to ensure uninterrupted QuickBooks function.

- Ensure you have enough space on your computer.

- Keep a backup of your company file before installing system changes.

When Should You Seek Professional Help for QuickBooks Error PS032?

You need to contact a professional support team if the Error PS032 persists even after you have tried all the standard troubleshooting solutions, such as updating QuickBooks, renaming the CPS folder, or updating tax tables. Reach out for expert advice when you can’t identify the root cause of the problem. If you have lost any data or suspect a corrupted file, contact experts immediately. The frequent appearance of errors causes a lot of confusion, and an expert helps you to resolve issues while saving time.

Conclusion

In the above article, we discussed some steps to resolve QuickBooks Error PS032. We have also provided all the simple methods that will be helpful for you to fix QuickBooks error PS032. If you ever have any other issues or errors, you can check out our other posts and let us know in the comments section below.

Quickbooks Tool Hub – Frequently Asked Questions (FAQs)

- Turn Off UAC.

- Change the name of the CPS folder.

- Use Repair to fix QB’s payroll error.

- Stop all QuickBooks processes.

- Go to your Home Page and select Pay Liabilities.

- Now, navigate to the payment check under the Payment History section.

- Click on the Delete button and press OK.

Yes, you can only if the status is not yet changed.

- Go to Employees and choose the Paycheque list from Run Payroll.

- Then select the cheques you want to delete.

- Tap on Delete and click on Yes or No.