How to Fix QuickBooks Error 30159 (Payroll Update Error)

QuickBooks error 30159 pertains to payroll. This standard error can reduce productivity and interfere with payroll processing. One of the biggest challenges customers may encounter, especially regarding payroll features, is QuickBooks error 30159. This is more than just a technological glitch; it jeopardizes the company’s overall operations, increases the likelihood of noncompliance, and affects payroll accuracy.

QuickBooks error 30159 is a payroll-related issue users encounter when updating or interacting with the company’s payroll. It typically includes an error notice alerting the user to the problem related to the QB-enhanced payroll service.

What is QuickBooks Error 30159?

A warning message stating that “QuickBooks has encountered a problem and needs to close. We are sorry for the inconvenience” when QuickBooks error 30159 occurs. We apologize for the trouble. This error may also appear for several reasons, such as the payroll subscription expiring or your QuickBooks membership ending. To resolve this problem, you must ensure your payroll membership is active. To identify the cause, you may access the QB tool hub. Additionally, the error will be fixed if you purchase a new subscription after the current one has expired.

Reasons or Potential Causes of QuickBooks Error 30159

QuickBooks error 30159 must be repaired since it can corrupt the company’s data. The PC frequently crashes when working on it, the program crashes or the system operates very slowly, which are significant indications of this issue. The following is a list of the various causes of payroll update error 30159.

- Inactive Payroll Subscription: If the payroll subscription expires, QuickBooks fails to authenticate the payroll service, resulting in an error.

- Corrupt Windows File: When Windows files get damaged, it affects communication between QuickBooks and Windows components, causing payroll errors.

- Incomplete QuickBooks Installation: Some payroll may appear missing if QuickBooks was not installed correctly.

- Incorrect Service Key: If the payroll service key is mismatched or wrong, then QuickBooks confirms the subscription.

- Damaged Company File: If you have a damaged company file, this can cause interruption on your payroll components.

- Incorrect Employee Identification Number: If there is an employee identification number issue, it could impact the verification process.

- Outdated Windows Version: Using an outdated version of the Windows operating system can lead to compatibility problems.

Read More: QuickBooks Unrecoverable Error Fix

The significance of QuickBooks Error 30159

Any interruption of QuickBooks error 30159 affects the system’s regular operation and causes significant delays. So, let’s discuss the implications of this error on the QuickBooks desktop one by one.

Payroll functionality disruption

- The payroll feature of QuickBooks is impacted, namely by error 30159.

- Payroll is an essential part of business operations that affects worker satisfaction and tax compliance.

Financial data accuracy

- QuickBooks may compute financial data improperly as a result of the error.

- Payroll data errors may result in financial irregularities and even legal issues.

Time and productivity loss

- Businesses may experience disruptions as employees work to correct the error.

- This loss in productivity could have a cascading effect on daily operations.

Risk of violations of compliance

- The correct computation and filing of payroll taxes may be impeded by QuickBooks Error 30159.

- Tax law violations may result in fines and legal action.

Company reputation

- Inaccurate payroll & financial records can damage a business’s reputation.

- Employees and clients are among the stakeholders who may stop trusting a company that struggles with financial management.

Financial planning difficulties

- It could be more challenging to create accurate financial reports due to the inaccuracies.

- These reports are used by businesses to formulate their upcoming financial strategy and make strategic decisions.

Customer and employee relations

- Payroll mistakes can have a detrimental effect on morale and lead to employee discontent and turnover.

- Customers may also be impacted when business activities are disrupted.

Long-term impacts

- If the error is not fixed immediately, it could impact the company’s growth and financial stability.

- Fixing this error is essential to the long-term viability of the company and its general health.

Symptoms and signs of QuickBooks error 30159

Because of the 30159 error code, one of the most frequent situations is producing systemic disturbances, and after this, the user constantly searches for solutions. However, what if you could look at a scenario where you could learn of the error’s occurrence beforehand? This might also save you a great deal of time and effort. Thus, let’s examine the symptoms and indicators before the occurrence of the error.

Codes and error messages

- Users may encounter particular QuickBooks update error codes, such as “Error 30159” or associated messages when processing payroll.

- Users may receive error messages informing them of issues with their payroll service and offering solutions.

QuickBooks are freezing or crashing.

- Regular operations could be disrupted if the software freezes or stops responding.

- The application may crash a lot while payroll tasks are being finished because of error 30159.

Inability to update payroll information

- Users may need help with processing or updating payroll data in QuickBooks.

- If you have issues updating employee information or cannot use payroll tools, Error 30159 can be the reason.

Impact on overall system performance

- The problem may cause a slowdown in the system’s overall performance.

- Delays in command execution and longer processing times can have a detrimental impact on overall system performance, particularly when they are connected to payroll-related tasks.

The outcome of disregarding or avoiding the error

Now, if you know that this error can harm your system and you are still avoiding it despite correcting it, don’t you believe it could damage your system and lead to numerous other problems? If you don’t know, let me explain the adverse outcomes that could happen if this error code 30159 is avoided.

- Payroll discrepancies: Inaccurate payroll calculations could affect employee compensation if Error 30159 is not fixed.

- Compliance issues: The business could face penalties for not adhering to tax regulations and reporting obligations if the inaccuracy is disregarded.

- Financial record inconsistencies: The error may impact the reliability of financial records, leading to discrepancies that may be challenging to rectify.

- Workflow disruptions: If the error is overlooked, regular payroll processing might be interrupted, affecting the business’s overall operation.

- Risks to data security: Ignoring bugs is a lack of concern for software maintenance, which could expose the business to data security risks.

Read More: Resolve QuickBooks Error PS036

Methods for Resolving QuickBooks Error 30159

After learning in detail about all the outcomes it can have once it erupts in your system, we should know the solutions to fix it comprehensively. Thus, to manually fix QuickBooks error 30159, follow the below steps.

Method 1: Restore to an earlier state of your system

You can implement System Restore if you notice the error after a system change. By simply restoring the system to its previous state, you will automatically reverse any updates that might affect the payroll. Once restored, QuickBooks gains access to system files again and fixes Error 30159.

- After turning on your computer, log in as “system administrator.”

- Press the “start” button on your keyboard.

- Next, select the “Restore” option under “All programs.”

- Once a new window has opened, choose “Restore my computer” and press the “Next” button.

- Click the “next” button again after selecting the latest system restore point.

- After finishing, select the “Confirmation window.”

- The system must then be restarted once.

- After rebooting, the “QB file repair tool” must be downloaded and installed appropriately.

- Once the QB file repair program has been installed, click the “scan” option.

- Once scanning is complete, click the “Fix error” button once.

- You must reboot your computer system when the “Success” screen appears.

Method 2: Install the latest versions of windows

Outdated Windows files often cause interruptions with payroll services. When you update Windows, missing security patches and system components get repaired. This improves compatibility between QuickBooks and the operating system, reducing payroll validation errors.

- First, press the keyboard’s “start” key.

- Then, type “update” into the search bar and press the “enter” key.

- If there are any updates, the operating system will monitor them.

- Try installing all of the updates if you find any there.

- Restart your computer after the procedure is finished.

Method 3: Including Employee Identification Number in your Company File

When payroll fails due to a missing EIN, you need to manually enter the Employee Identification Number.

- First, log in as “system admin” to QuickBooks.

- Next, select the “choose payroll” option.

- The user must then select “Use my existing payrolls service.”

- On your desktop, a new window called “Account maintenance” opens.

- Click the “Add file” option after that.

- Make sure to click the “add EIN Number” radio button.

- It should be mentioned that if the radio button isn’t active, it signifies the user had previously signed up for your company’s “EIN Number.”

- Click the “Next” button after that.

- Examine the details and launch QuickBooks.

Method 4: Modify your Payroll Service Key and Enter it again

Delete the old payroll service key and re-enter a valid one when subscription verification fails. This forces QuickBooks to reconnect with payroll services and authenticate our account properly.

- First, you must navigate to the employee’s data menu.

- Additionally, choose the My Payroll service.

- In addition to clicking on account/billing information, you must tap on the manage service key.

- The next step is to find and select your payroll service key and then choose the delete tab.

- After completing that, select the “add” option.

- Insert your valid payroll service key alongside.

- Select the “Finish” to complete the process and click “ok.“

Read More: Set up Multi-User Network in QuickBooks Desktop

Method 5: Run an Error Scan for QuickBooks

We use the payroll error tool to scan payroll-related components. This tool automatically detects damaged files and repairs them. Once scanning is complete, payroll services usually function without interruption.

- First, the QB payroll error tool must be downloaded.

- Installing the application is the next step.

- To begin the scanning process, tap the scan icon and start tab.

- Once the scanning process is complete, choose QuickBooks-related concerns.

- Finally, restart your computer.

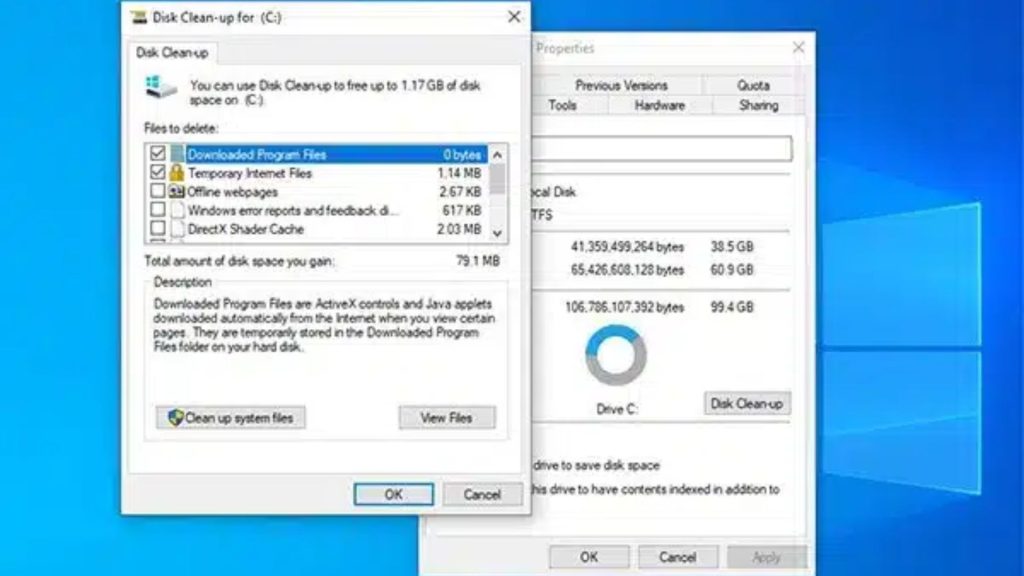

Method 6: Clean Up the Disk in Windows

Temporary files and junk data sometimes interrupt payroll updates. When you perform disk cleanup, unnecessary files are removed. This frees the system space and prevents conflicts during payroll processing.

- You must click the Start tab to remove the temporary files during this process.

- After completing that, select the Enter tab.

- Decide which drive you wish to free up.

- Click the ok tab as well.

- The following step is to select and delete all unnecessary files, after which you click the “ok” tab.

- In disk cleanup, choose Clean Up System Files.

- After choosing the file types, select the “ok” tab.

- This would further free up the necessary space by deleting all unnecessary files from the system.

Method 7- Verify your Payroll Subscription Status

Inactive subscription is one of the main causes of 30159 Error, so always confirm whether your payroll status is active or not. Once reactivated, QuickBooks can successfully download payroll updates.

- Go to the employee’s page in QuickBooks, choose My Payroll Services, and then select Account and Billing Information.

- After entering your login information, click “Sign In.”

- Choose the method you wish to use to validate your identification on the “Confirm Your Account Information” window.

- Click “continue” after receiving the confirmation code by email or your phone number.

- In the “enter your confirmation code” window, enter the six-digit confirmation code you received, then click “continue.”

- After logging in, check to see if a payroll subscription is valid. If not, activate it by following the directions.

- To determine if QuickBooks error 30159 has been fixed, update your payroll tax table.

Method 8- Repair the paysub.ini file

By adding .old to the final part of the file name, QuickBooks will not be able to use the paysub.ini file if it is corrupted. Once you rename the file, QuickBooks Desktop will automatically generate an entirely new paysub.ini file for you to utilize.

Method 9- Retry after updating QuickBooks Desktop to obtain the payroll updates

Running an outdated version often triggers payroll errors. When we update QuickBooks, the security improvements help to fix bugs. After updating, the payroll update downloads successfully.

- An outdated QuickBooks desktop may cause a payroll update error. For this reason, we will update the QuickBooks desktop first, then try again to obtain the payroll update.

- Open QuickBooks Desktop, then select the Help tab from the top menu bar.

- Select “update QB desktop” from the drop-down list of options, then select the “update now” tab.

- After downloading the updates, click “get updates” and restart QuickBooks.

- To see whether this solution has fixed the issue, click Install Now to install the downloaded updates into the application. Then, try downloading the payroll updates again.

Read More: Resolve QuickBooks Bank Feeds Not Working Error

Method 10- Using the File Checker in Windows

Run the System File Checker tool when the system files are corrupted. This repairs damaged Windows files, which may block the payroll processes.

- Enter your credentials as the system administrator.

- Press the keys Windows+R. The run box will open as a result.

- Next, type cmd, then hit Enter.

- Type scan now/sfc into the black window that displays, then hit Enter.

- The operation will finish in a few seconds. Next, follow the remaining instructions to restore the issues within the system files.

It should resolve this QuickBooks error 30159.

Method 11- Ensure that QuickBooks Desktop Payroll has the most recent Tax Table Update

Keeping your QB desktop Payroll tax table up to date is critical to guarantee correct paycheck computations and compliance. Here’s how to obtain the most recent version of the tax table:

Verify the version of your current tax table:

- Navigate to the Employees section.

- Choose to Receive Payroll Updates.

Check to see if it’s the most recent version:

- Check the most recent payroll news and updates to ensure your tax table edition is current.

- Tap on Payroll Update Data for more information.

Get the most recent version of the tax table:

- Click Download the entire update from the payroll updates window.

- Click “Update.”

- After the download, you will receive an informational popup verifying the update.

Method 12- Verify your system’s time and date settings

If the date/ time on your system is off, you can see QuickBooks error 30159. The following procedures will allow you to update and confirm the system’s time and date:

- Navigate to the Windows start menu and select Settings.

- Go to Settings > Language & Time > Date and Time.

- Press Enter after setting the time and date.

Method 13- Install the security certificate for QuickBooks desktop

Setting up a safe network link in QuickBooks requires a Secure Sockets Layer (SSL) certificate. It is employed to protect user information. Payroll error 30159 in QuickBooks may be caused by a wrong or invalid security certificate. The procedures listed below can be used to install and validate the QuickBooks security certificate:

- First, select Properties by pressing shift + F10 on QuickBooks icon.

- On the Shortcut tab, select Open file location, then select OK.

- After that, install the certificate by following these steps:

- Look for an Application file (.exe file) on your File Location page, then right-click it and choose Properties.

- The window for Application file properties appears.

- Select an entry from the signature list field after selecting the Digital signature option.

- Click on Details.

- Then tap View Certificate in the Digital Signature Details window.

- Hit Install Certificate on the Certificate page.

- The Certificate Import wizard’s welcome dialog box will appear.

- Click Next after confirming that the current user has the store location.

- The certificate store is automatically chosen based on the certificate type from the Certificate Store page.

- After selecting Next, select finish.

- The notification “import was successful” appears in a dialog box. Press OK.

Method 14 – Further methods for Troubleshooting

When multiple payroll agreements exist or there is any service key mismatch, it is important to verify the account details carefully. Restarting your computer system can help to fix this error.

- To determine whether you have multiple active payroll agreements with inactive direct deposit agreements, visit QB desktop payroll A/c maintenance.

- Restart your computer.

- Verify the service key and PSID specified in the payroll information.

- Afterward, restart the QuickBooks desktop update.

Read More: Fix QuickBooks Won’t Print Issue

How to Prevent QuickBooks Error 30159?

Maintaining the accuracy of your payroll setup can help you prevent QuickBooks Error 30159. Keep your QuickBooks desktop updated with the latest payroll taxes table. Regularly verify your employee details to avoid mismatched data, especially the payroll subscription information. Check and update your EIN regularly from your company file settings. Also, ensure that the Windows updates are installed and there are no damaged QuickBooks files. Configuring antivirus and firewall settings allows QuickBooks to prevent communication blocks. By checking your payroll settings regularly, you can ensure seamless payroll operations.

When to Seek Professional Help for QuickBooks Error 30159

QuickBooks Error 30159 interrupts employees’ payables and causes serious concern if the payment deadlines are near. When you have attempted every basic troubleshooting but are still unable to fix the error, it is advisable to consider professional advice. Therefore, contacting QuickBooks professionals can help you to resolve your issues quickly. It saves your time and avoids complications with your employee payments. Our experts will help you to solve Error 30159 while keeping your financial data secure and ensuring compliance.

Conclusion

Thus, we can conclude that QuickBooks error 30159 occurs for many reasons, such as when the payroll subscription becomes inactive/ expired, or some outdated version is installed in the system, among many other reasons. But the main thing that becomes the priority is how to resolve this issue, and that is the reason that by understanding the nature of this error, we have brought up a list of comprehensive solutions through which one can fix this issue and avoid the hindrance and disruptions caused in one work.

After reading this article, I realized that any issues or concerns one might have were resolved to the maximum extent. However, if someone still needs help, we are here to resolve this issue.

Frequently Asked Questions (FAQs)

When users attempt to update or install QB software, they frequently encounter error 30159. This error typically occurs due to registry issues, faulty system files, malware or virus attacks, or improper or incomplete installation. Additional causes of the error may include an old version of QuickBooks or Windows, an incomplete QuickBooks Payroll installation, or issues with the .NET Framework.

You can resolve QuickBooks Error 30159 in several ways. Among these techniques are:

- To resolve the issue, launch your QB Payroll update tool.

- Install the most recent versions of QuickBooks and Windows software.

- Confirm that your payroll subscription is active.

- A QB software must be processed through a clean installation using clean install tool.

- Run the QB file doctor program to fix any damaged files.

You can do the following to stop QuickBooks desktop error 30159 from happening:

- Ensure that your Windows and QuickBooks programs are always up to date.

- Regularly perform malware and antivirus scans to defend your computer from virus attacks.

- When installing or updating QuickBooks software, ensure your internet connection is steady and dependable.

- Refrain from setting up different QuickBooks software versions on the same machine.

- To avoid data loss, always make a backup of all your QuickBooks data.

You may encounter this issue when attempting to add to an active payroll subscription. However, this error may occur in several situations, such as while calculating payroll taxes, running payroll, or receiving payroll updates.