QuickBooks is a leading software with a lot of advanced features. Businesses find it easy to use as with the help of this they can make payments, be able to create invoices, and send them to customers through email, and also you can keep track of your employee time and hours they spent on particular work. If you want to keep track of any changes made in the company file & by whom you can do QuickBooks audit trail removal.

But sometimes you see that your company file is too large as there are some transactions and useless elements. So, to avoid this you need to turn off your audit trail with the use of QuickBooks audit trail. By doing this you can increase the speed of your software as it reduces the size of the company file.

In this guide, we will help you out with why you should turn off the audit trail in QuickBooks, factors that make your system slow, and how to turn off the audit trail. Let’s begin.

What Is QuickBooks Audit Trail?

With the help of the QuickBooks audit trail, you can check all the changes made in the company file and by whom. It also acts as a savior in case you have a lot of transactions to be recorded. While recording you may see that your file is too large then in that case you need to turn off the audit trail in QuickBooks.

Importance of Audit Trail in QuickBooks

The importance of the audit trail is given below:

- It’s easy to check if any changes have been made by any user.

- You can get the name of the past accounts that are combined with the current accounts.

- In case you have deleted or lost any transaction you can get it back.

- This allows you to verify and check any transaction by tracking user activities.

Some of the Causes that make your System Slow

We are mentioning the causes that make your system slow and how you can avoid them.

- It happens due to some of the transactions that are useless but coming in the company file.

- You should erase or delete old transactions which are of no use to make your performance better.

- Whenever you delete or make any changes in the transactions it monitors them all and shows them in the software.

- Another reason can be because of the size of the company file.

Also Read: QuickBooks Component Repair Tool- Full Guide

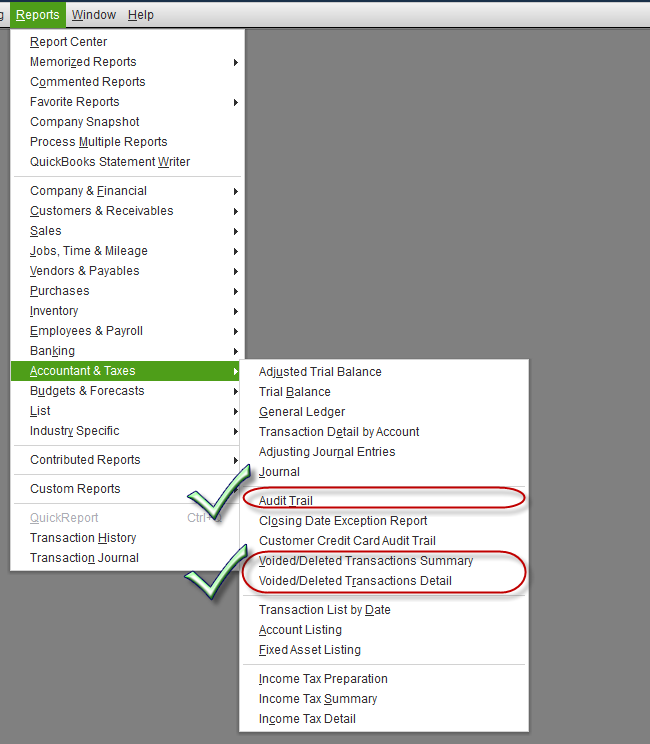

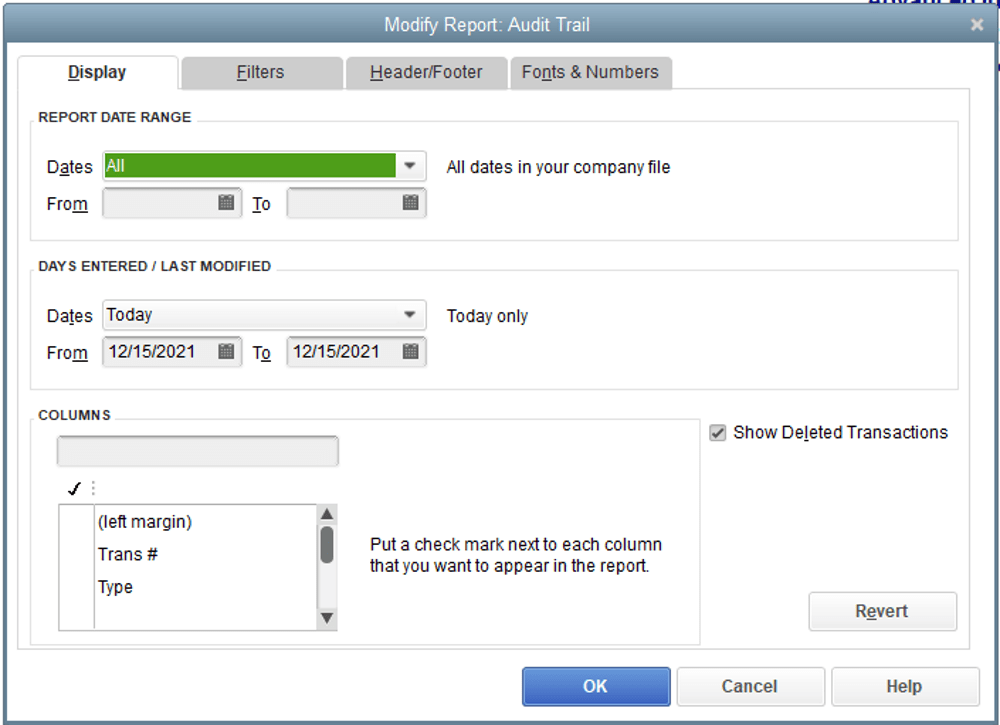

How to Create QuickBooks Audit Trail Reports?

Here are the steps that you should follow to make reports in the QuickBooks audit trail:

- Firstly, Run your QuickBooks account.

- Then click on Reports and tap on the Account and Taxes menu.

- Now, press on to the Audit Trail.

Why Remove Audit Trail from QuickBooks?

If you remove your audit files then it will help you to sort the data based on deleted summaries of transactions. Also, your file size will decrease and you will be able to work in a better way. This will increase the speed of the software and you can increase your productivity.

Also Read: How to Restore a Portable File in QuickBooks?

How to turn off Audit Trail in QuickBooks?

Do these steps to turn off the audit trail in QuickBooks so that you can reduce the size of your company files by removing unused items and transactions.

- Tap on the File option and select Utilities.

- Now, choose Condense Data, and from your company file window click on Keep all transactions.

- After that erase the Audit trail info to date radio.

- At last, you can follow on-screen instructions.

Conclusion

Therefore, based on the blog post above, we can be sure that QuickBooks audit trail files, which document program modifications, can assist a user in preventing fraud. When the accounting program starts to malfunction or deteriorate, it can be necessary to remove it. The post gave you a thorough tutorial that covered every aspect of QuickBooks’ audit trail, including how to delete audit logs if the file got too big.

As a result, the information above will be helpful to you. However, if you still require assistance, please contact us directly; our trained professionals are here to help and advise you

Frequently Asked Questions

Q1. In QuickBooks software, what does the Audit Trail mean?

An audit trail can be used to confirm and authenticate software, business, and financial transactions by tracing specific user actions or accounting financial statements back to the event source, transaction, and data access needed to create or modify a record. Fraud, errors, and illegal use can all be found using an audit trail.

Q2. What does it mean to delete the audit trail from your QuickBooks software?

It means:

- By enabling you to remove audio files through your QuickBooks files, QuickBooks helps you speed up your processor.

- Sorting the data, including your erased transaction summary and company details report, is made easier when audit files are removed from QuickBooks.

- Audios are typically cleared meanwhile you are processing your data with government agencies, and audit trails assist you in managing your company’s data.

Q3. How can I remove some audit trail data from my QuickBooks account?

Following the instructions listed below will allow you to clear the specific audio data file:

- The tax codes for VAT returns.

- Your company’s current fiscal year data.

- Files that are fully compensated.

- Review your bank statements.

Q4. How can I remove QuickBooks Desktop’s audit trail?

You can use the utilities tab in QuickBooks Desktop to remove the audit trail. You can choose which information to omit and condense here.

Q5. How can audit logs be removed from QuickBooks Online?

In QuickBooks Online, audit logs can be deleted by visiting the utility area. You can then decide which transactions/records you wish to delete after selecting Condense Data.

![How to Use Clean Install Tool Quickbooks [Complete Guide]](https://qbtoolhub.com/wp-content/uploads/2021/04/page_1-1024x576.jpg)