How to Solve QuickBooks Payroll Error PS077

QuickBooks Payroll Error PS077 is a common payroll update issue that affects many QuickBooks Desktop users. This error blocks the payroll tax table update process and interrupts the regular payroll activities. Payroll tasks such as salary calculation, tax filingand employee payments may stop due to this issue. Businesses often face delays and workflow problems after this error appears.

This QuickBooks Payroll Error PS077 is associated with payroll software that hinders the working procedure. It can occur whenever the user tries to update QuickBooks payroll software. To kick out this error from your device, you must get into the post.

| Error Message | QuickBooks is having trouble installing payroll tax table updates. |

| Error Code | PS077 |

| Error Cause | Incorrect software settings |

| Error Solution | Repair QB desktop |

What is QuickBooks Payroll Error PS077?

This QuickBooks Payroll Error PS077 usually appears during the payroll update process and displays a message related to payroll task table installation failure. You can encounter the message provided above. Error PS077 belongs to the QuickBooks Payroll (PS) error series, which points to payroll setup or the subscription related issues. In some cases, damaged company files or incorrect billing details also trigger the issue. Since payroll accuracy is important for every business, it becomes necessary to resolve these issues at the earliest stage.

Well, QuickBooks Payroll is known for its smooth payroll services. Receiving any error text inside it can lead to so many problems. You may end up with no payment to your client and other transactional issues. Though the error is common many users still don’t have knowledge on eradicating it. So, make sure to move with us to this post and learn several ways of troubleshooting.

Reasons Behind the QuickBooks Payroll Error PS077

Understanding the reasons behind Error PS077 will help you to diagnose and fix the problem fast. From our experience of troubleshooting user queries, we have identified these common triggers:

- QuickBooks Can’t Read Registration Information: When QuickBooks is unable to verify or access the software registration data stored in your system, it blocks the payroll update process as a security measure.

- Incorrect Billing Information on Payroll Account: If your payroll account is outdated, mismatched, or contains any invalid billing details that don’t match Intuit’s payment records. Expired credit cards, incorrect account information, or changed addresses prevent Intuit from authenticating your subscription during payroll updates.

- Damaged Tax Table Files in QuickBooks Payroll: When the tax table files within QuickBooks Payroll components become corrupted or remain incomplete, QuickBooks can read the data and shows Errors texts.

- Outdated Billing Information: If you don’t update your billing information for months or years, it may contain old contacts and expired payment methods. QuickBooks can’t verify your active subscription status with the outdated information.

- Corrupted QuickBooks Company File: When your company file contains data corruption, it affects payroll setup sections or the subscription authentication process. This prevents QuickBooks from accessing payroll features and downloading tax table updates.

- Unregistered QuickBooks Software: If you have not completed the QuickBooks registration process with Intuit or if your registration has become invalid, QuickBooks will restrict your access to payroll services.

Symptoms of QuickBooks Payroll Error PS077

Before Error PS077 appears, QuickBooks shows some warning signs. Understanding these symptoms will help to address the Error before it disrupts your payroll processing.

- Unable to Update Tax Tables: You attempt to download the latest payroll tax tables, but the update process fails immediately or stops partway through.

- Cannot Download Payroll Updates: Each time you try to download payroll updates via the Get Payroll Update option, the process fails.

- QuickBooks Frequently Freezes: You experience frequent freezes, especially when trying to access payroll features.

- Computer Performance Slows Down: Your system responds noticeably slowly when QuickBooks is open. Simple tasks take longer than usual, and programs respond sluggishly.

- Payroll Processing Stops Working: You can’t process employee paychecks or calculate taxes correctly. QuickBooks blocks payroll operations until the tax table updates successfully.

Points to Remember Before Performing QuickBooks Payroll Error PS077

- First of all, check and verify that the user has only one QuickBooks software in your system

- Check and validate the QuickBooks Payroll subscription

- Repair the software to avoid or correct the problems in your account

- Your payroll account should have the correct billing information

- Before the update, upgrade, or, repair of the QuickBooks company file take the backup of the company file.

- Also, update the QuickBooks desktop account to the latest version.

- You have to authenticate the QuickBooks Payroll Subscription

- Check if the billing information mentioned in the payroll account is correct.

How to Solve the QuickBooks Payroll Error PS077?

The user is required to perform the below-mentioned solutions to resolve the QuickBooks Payroll Error PS077 in QB payroll.

Solution 1: Close All Opened Payroll Windows

Sometimes, if you open multiple QuickBooks windows or background processes simultaneously, it prevents updates from installing properly. Closing all the QuickBooks background processes often resolves the errors without any complex steps.

- First, log out from the QuickBooks account.

- After that, make sure not a single window in your payroll system is open, so close all the windows in the first place.

- To verify all the windows are closed open the task manager by clicking the Ctrl+alt+Delete key together.

- Now, reopen the QuickBooks Desktop again and try to download the QuickBooks payroll.

If the QuickBooks payroll starts downloading then you are good to go for further work but if the error still persists, then move to the next step.

Solution 2: Update QuickBooks Desktop

Running an outdated QuickBooks version creates compatibility issues with Intuit servers and the recent payroll tax tables. Update your QuickBooks from Intuit’s website to solve the critical bugs and compatibility patches.

The next solution includes some steps to resolve the QuickBooks payroll error ps077.

- Open the QuickBooks accounts and check the QuickBooks License. The user should have the latest updates for the QB version.

- Now verify the details like billing information dates available on the QuickBooks payroll service account information.

- Go to Files and click on the Utilities option to verify and create the QuickBooks Data.

- For users having Microsoft Windows 7 and 8, you need to switch off the UAC and after that, you need to try downloading the QB payroll updates.

If this solution resolves the error then enjoy using the QuickBooks payroll, if not then go for the next method.

Solution 3: Verify Your QuickBooks License

An invalid, expired, or incorrectly registered QuickBooks license prevents the software from authenticating your payroll subscription. This quick check often reveals registration issues that block payroll functionality.

From QuickBooks Desktop:

- Open your QuickBooks Desktop application.

- Press F2 from your keyboard to open the Product Information window.

- Navigate to the License Information section to check the status.

- If the status is not active, navigate to Help.

- Select Manage My License.

- Click on Sync License Data Online.

From QuickBooks Online:

- Start with Login into your account.

- Next, click on the Gear Icon.

- Go to Account and Settings.

- Navigate to Billing & Subscription to verify the status.

- If the status is not active, go to Settings.

- Navigate to Subscription and Billing.

- Select Resubscribe and update billing information.

Solution 4: Re-install QuickBooks Desktop Version

Corrupted QuickBooks installation files prevent the software from processing payroll updates correctly, causing Error PS077. Reinstallation replaces the corrupted program files with clean copies, giving QuickBooks a fresh start.

In the third method to resolve QuickBooks Payroll Error PS077 the user has to perform these simple steps in two different cases:

- If the user is using a single version of QuickBooks

- If the user is using multiple versions of QuickBooks

Case 1: Single Version QuickBooks

If the user is having a single version of QuickBooks in his/her system then he/she doesn’t have to perform any other method to resolve the error just follow these steps, and the error will redeem itself.

- Create a backup of the Quickbooks company file.

- Check and close all the Applications running in the background.

- Now open the Run Window in your system, the following steps to open run in your system whether you are using.

Read Also: How to Set up Multi-User Network in QuickBooks Desktop?A: Windows 8

- Go to the Windows System Tab.

- Now, Click and open the Start Screen.

- Right-click the option background to all apps.

- Finally, select the Run option.

B: Windows 7 and XP

- Click on the Start button if you are not logged in as the administrator.

- Now, go to the All Program option and select Accessories.

- And then, click on the Run option.

C: Windows Vista

- Click on the Start button

- And go to the search field

- Now, enter Run, and hit the enter button on the keyboard.

Now when the Run option prompted on your screen

- Now in the open field type control and click on the ok option, the control panel is now open.

- Now, go to the programs and feature option and double-click on it.

- After that, a list of all programs installed in your multiple versions of Qukcbooks will open up

- Now, select those Quickbooks Desktop programs you want to delete

- Click on the change/remove option or in vista, you will see uninstall/change option, click on it

- Now the Quickbooks desktop installation Wizards open

- After that, click on the Next button after selecting the Remove option.

Case 2: If the User has Multiple Versions of QuickBooks

In the second case scenario, if the user is having Multiple Versions of QuickBooks in his/her system then perform a clean installation process of the QuickBooks desktop version with the help of the QuickBooks Clean Install Tool. Follow the steps to complete the process.

- Reset the QuickBooks update for multiple versions of QuickBooks after uninstalling all the additional Installations on your system.

- Now, the user is required to download the latest payroll tax table

- Re-sort the list, and then use the verify Data/rebuild data Process (rebuild data only if required)

- Now, perform a Clean Uninstall/reinstall in selective startup mode.

Solution 5: Downloading QuickBooks and Latest Payroll Tax Table

Outdated payroll tax tables or incomplete update attempts block new updates from installing. Resetting the update process clears all corrupted update files and resolves Error PS077.

- Start the procedure by removing the existing and additional installation.

- Thereafter, navigate towards the Help menu.

- From there, choose Update QuickBooks.

- Also, try to reset the QuickBooks update.

- Then, you need to download the latest payroll tax table.

- Try to go through the lists

- Choose the Selective Startup method to conduct a clean uninstallation of QuickBooks.

- Finally, just update the tax table.

Solution 6: Update Billing Data in QuickBooks

Outdated or incorrect billing information in your QuickBooks payroll account prevents Intuit’s server from authenticating your subscription. Updating your billing data re-establishes the connection between QuickBooks and Intuit’s payroll servers.

- Open QuickBooks Desktop.

- Navigate to settings.

- Select Subscription and Billing.

- Then, go to the Billing details tab.

- Select Edit Billing Information.

- Update your information, such as payment method, address, or plan.

- Click Save to confirm changes.

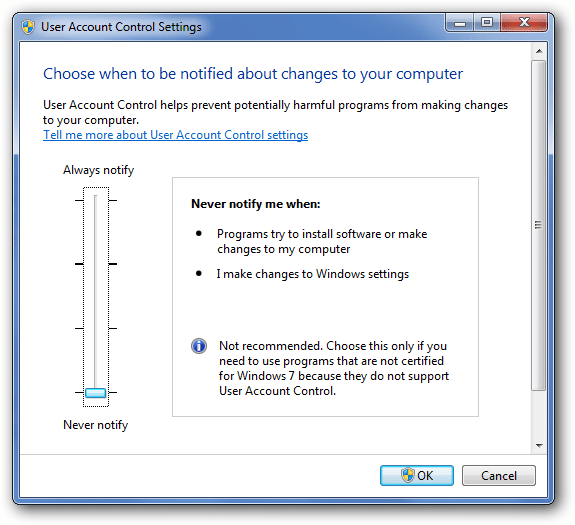

Solution 7: Turn Off UAC

User Account Control (UAC) restricts QuickBooks from accessing critical system files needed for payroll updates. Temporarily disabling it gives QuickBooks the required permission to access all necessary system locations.

- First of all, press the Windows + R buttons.

- Thus, open the Run window.

- Make sure to specify Control Panel there.

- Also, choose OK.

- Pick User Accounts.

- Then, click on User Accounts (Classic View)

- Thereafter, the user needs to pick Change User Account Control Settings.

- Choose Yes when receiving a prompt from UAC.

- Just move the slider to Never Notify to disable the UAC.

- Finally, choose OK.

Solution 8: Modify the CPS Folder name

The CPS folder stores payroll configuration and tax table files that can become corrupted over time. Renaming this folder forces QuickBooks to create a fresh CPS folder and resets the entire payroll configuration without risking data loss.

- Open the File Explorer by hitting Windows + E buttons.

- Then, click on the PC button.

- Visit the Local Disk C option.

- Just access the program file folders if there are some issues while finding the program files.

- Thereafter, just access the QuickBooks desktop folder that has the same version.

- Launch it.

- Navigate towards the Payroll folder.

- Subsequently, perform a right-click on the CPS folder.

- Also, select the Rename button.

- Make sure that you need to rename it as CP SOLD.

- Then, hit Enter.

- Create a new folder for CPS.

- Afterward, access QuickBooks.

- Try to update the latest payroll tax table to move further.

Read Also: Steps To Resolve QuickBooks Error PS032Solution 9: Create a New User Account

Corrupted Windows user profile settings or permission restrictions on your account can block QuickBooks from accessing payroll features properly. Creating a new administrator account with complete system permissions enables QuickBooks to run payroll updates without user profile-related interference.

To add a fresh user account, follow the instructions below.

- After pressing the “Windows” key, select “Settings.”

- Select “Add another individual to this PC” in the “other users” option.

- Select the “I don’t have this Person’s log-in Information” icon.

- Choose “add a user without the microsoft account” after that.

- The new account has to be given a name.

- Choose “Finish” now.

- Choose the account you created.

- Next, pick “Account Type” and hit the “Administrator” option.

- Click “ok.”

- Open QuickBooks to access your company file or files. Hopefully, the QuickBooks error ps077 won’t show up this time.

How to Prevent QuickBooks Error PS077?

Preventing Error PS077 requires focused attention on the payroll subscription management and file integrity. Follow these prevention measures to solve payroll-related errors:

- Keep only one version of QuickBooks Desktop installed on your system to avoid software conflicts.

- Download the latest tax table updates immediately after Intuit releases them.

- Run the Verify Data utility weekly before processing payroll to catch the corrupted files.

- Ensure your billing information matches with the actual payment method.

- Register your QuickBooks software properly with valid license information.

- Maintain the correct Employer Identification Number and payroll service key to avoid authentication failure.

- Keep a backup of your company file before every payroll update to protect against data loss.

When Should You Ask for Professional Help for QuickBooks Error PS077?

Our experts are trained to handle issues where standard troubleshooting doesn’t resolve the issue. Recognizing when to reach for professional assistance prevents payroll disruptions from becoming business issues. You can contact us if:

- The Error persists even after trying the basic troubleshooting steps.

- Your billing information is correct, but QuickBooks is still not able to authenticate payroll registration.

- Your payroll deadline is approaching, and you can’t afford trial-troubleshooting.

- Multiple employees’ payroll calculations are affected.

- You face compliance issues.

- The Error PS077 appeared suddenly after a Windows update.

In such cases, experts can offer the right solutions, saving your time and unnecessary stress.

Conclusion

So, here we reach the end of the ost. We hope you like it and resolve the error issue. Make sure to consult with our experts if there is any other problem that appears in your mind. We hope that you like this article. Do check out our other articles as well which would be masterpieces for many of you struggling with different payroll errors.

Frequently Asked Questions (FAQs)

- Choose Employees and click on Get Payroll Updates.

- Tap on Download Entire Update and select Download Latest Update.

- A window will appear once the download is finished.

With the help of QBs advanced payroll, you can manage the time sheets, pensions, and other payroll accounts.

Intuit payroll helps in managing the payroll of your business while QuickBooks handles basic accounting needs.

- Log in to QBs Desktop company file as Payroll Admin.

- Then choose the Payroll Center and from the Payroll option, you can see which payroll service you were using.

Yes, it is one of the most common causes of the Error PS077. When your subscription expires, QuickBooks fails to authenticate your access. Verify that your subscription is active before processing with troubleshooting steps.

It depends on the cause. When the error is caused by corrupted QuickBooks installation files you can use Tool Hub to resolve the issue. However, for billing-related issues or expired subscriptions, you need to update that information manually from QuickBooks.